American Tower Corporation Outperforms Market with Strong Q1 Results

American Tower Corporation (AMT), headquartered in Boston, Massachusetts, stands as a top independent operator and developer of multitenant communications real estate. With a market capitalization of about $103 billion, its operations extend across the Americas, Europe, Africa, and the Indo-Pacific.

Market Performance and Comparisons

Over the past year, American Tower has notably outperformed the broader market. The stock has surged 18% in the last 52 weeks and 19.9% year-to-date (YTD), contrasting with the S&P 500 Index’s ($SPX) 8.6% gains over the past year and a 3.8% decline anticipated for 2025.

Focusing on industry benchmarks, AMT has outshined the JPMorgan Realty Income ETF (JPRE), which saw returns of 11.4% over the past year and a modest 1.3% YTD increase.

Q1 Results and Future Expectations

Following the release of strong Q1 results on April 29, American Tower’s stock gained 4.8%. The company reported a 2% year-over-year increase in revenue, totaling $2.6 billion, which exceeded analysts’ expectations. Furthermore, its adjusted funds from operations (AFFO) rose by 7.1%, reaching $1.3 billion, with AFFO per share at $2.75—10.4% above consensus estimates.

Looking ahead to the fiscal year 2025, which ends in December, analysts forecast a 3.8% year-over-year decline in AFFO per share to $10.14. Nevertheless, American Tower has a strong track record, having surpassed AFFO estimates in each of the past four quarters.

Analyst Ratings and Price Targets

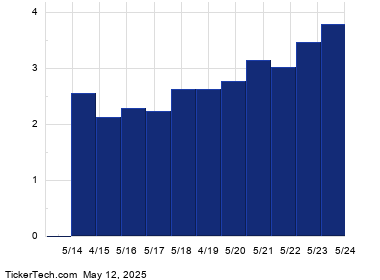

The stock currently holds a consensus “Strong Buy” rating, as indicated by 23 analysts, including 17 “Strong Buys,” two “Moderate Buys,” and four “Holds.” This is an improvement from two months ago when only 16 analysts had given “Strong Buy” recommendations.

On May 1, RBC Capital analyst Jonathan Atkin maintained an “Outperform” rating on AMT, raising the price target from $240 to $250. The mean price target of $245.48 implies an 11.6% premium over current price levels, while the street-high target of $265 indicates significant upside potential at 20.5%.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.