Cisco Systems to Announce Important Q3 Fiscal 2025 Results Soon

Cisco Systems (CSCO) is scheduled to release its third-quarter fiscal 2025 results on May 14.

Revenue and Earnings Expectations

The company anticipates revenues for the third quarter to range between $13.9 billion and $14.1 billion. Non-GAAP earnings are expected to be between 90 and 92 cents per share.

The Zacks Consensus Estimate projects revenues at $14.05 billion, reflecting a growth of 10.58% compared to the same quarter last year. The consensus for earnings has remained steady at 91 cents per share over the past 30 days, indicating a year-over-year growth of 3.41%.

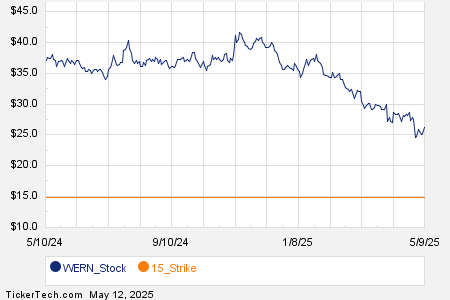

CSCO has outperformed the Zacks Consensus Estimate in the last four quarters, with an average beat of 4.07%. (Find the latest EPS estimates and surprises on Zacks earnings Calendar.)

Cisco Systems, Inc. Price and EPS Surprise

Cisco Systems, Inc. price-eps-surprise | Cisco Systems, Inc. Quote

As we approach this announcement, let’s examine the key factors impacting CSCO’s upcoming results.

Key Factors Influencing CSCO’s Q3 Earnings

Cisco’s third-quarter results are likely to reflect strong demand for networking products, particularly in switching, enterprise routing, webscale infrastructure, and industrial applications. The return-to-office policies are expected to have improved demand for CSCO’s campus switching offerings. Additionally, demand for data center switches has surged, spurred by the launch of 800gig Nexus switches utilizing Cisco’s 51.2 terabit Silicon One chip.

The Zacks Consensus Estimate for fiscal third-quarter Networking revenues stands at $6.76 billion, pointing to a 3.6% year-over-year growth.

Cisco is also experiencing significant growth in its security sector, driven by demand for solutions such as XDR, Secure Access, and Multicloud Defense suites. The recent acquisition of Splunk has been a vital contributor, with security orders more than doubling year over year in Q2 due to enhanced threat intelligence capabilities.

The Zacks Consensus Estimate for fiscal third-quarter Security revenues is $2.195 billion, indicating a 68.3% year-over-year increase.

On the downside, higher tariffs following the “Liberation Day” announcement and general macroeconomic challenges are expected to negatively impact Cisco’s order growth in the upcoming quarter.

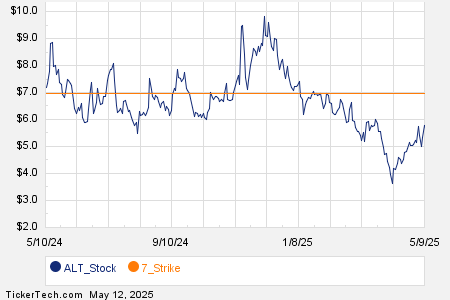

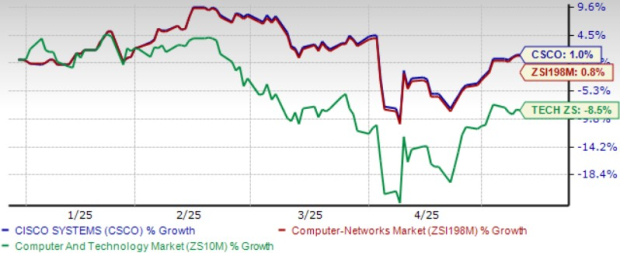

CSCO Shares Performance vs. Sector

Cisco shares have gained 1% year-to-date, outperforming the Zacks Computer & Technology sector, which has declined by 8.5%. The Zacks Computer Networking industry has posted a return of 0.8%, while peer Extreme Networks (EXTR) has seen its shares drop by 11.5%.

CSCO Stock Performance

Image Source: Zacks Investment Research

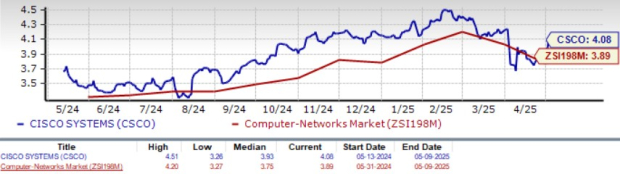

Despite its performance, Cisco stock shows signs of being overvalued, indicated by a Value Score of D. Currently, CSCO trades at a forward 12-month P/S ratio of 4.08X, higher than the industry’s 3.89X and Extreme Networks’ 1.63X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

Cisco’s Future Prospects Driven by Strong Portfolio

The surge in AI-related workload provides Cisco with substantial growth opportunities, thanks to its innovative offerings. The company has made aggressive investments in AI, cloud, and security. By the end of the first half of fiscal 2025, Cisco had secured more than $700 million in AI infrastructure orders and is on track to exceed $1 billion in fiscal 2025.

Cisco’s strategy includes integrating AI across its Security and Collaboration platforms while developing Agentic capabilities within its product range. The company is utilizing Agentic AI to enhance customer experiences. Notable advancements include the launch of the Renewals Agent, an AI-driven solution co-developed with Mistral, and a new Assistant designed to help customers manage Network Change Management more effectively.

In terms of security, Cisco Secure Access and XDR have gained traction, collectively attracting over 1,000 customers in the past year, with each product serving approximately one million enterprise users. Hypershield is also receiving increased adoption.

Strong Partner Network Enhances CSCO’s Outlook

Cisco boasts a robust partner ecosystem that includes Meta Platforms, Microsoft, NVIDIA (NVDA), Lenovo, and ServiceNow (NOW).

The collaboration with NVIDIA is expanding Cisco’s data center infrastructure, with the new NVIDIA-powered AI server and AI PODs integrated with NVIDIA’s AI Enterprise cloud-native software and managed via Cisco Intersight, all contributing to simplifying and securing AI infrastructure. Cisco is also unveiling an AI factory architecture developed with NVIDIA, which is expected to boost AI-driven revenues.

The partnership with ServiceNow integrates Cisco’s infrastructure and security platforms with ServiceNow’s AI-driven solutions, enhancing overall AI risk management and governance by combining Cisco’s AI Defense capabilities with ServiceNow SecOps.

Conclusion

Cisco’s short-term results are projected to benefit from a strengthening networking and security business, supported by a solid partner network. However, challenges remain, including tariff-related issues and broader macroeconomic headwinds.

Cisco currently holds a Zacks Rank #3 (Hold), suggesting that investors may want to wait for a more opportune moment to buy the stock.