Which Tech Giants Could Surpass Apple in Market Value?

Apple(NASDAQ: AAPL) has defined the big tech landscape over the past decade. For most of that time, it has held the title of the world’s largest company, although currently, Microsoft is in that position. Yet, there are strong contenders that may surpass Apple’s market cap within the next five years.

The potential challengers are likely familiar names, as only large companies can realistically outpace Apple. The top three candidates are Nvidia(NASDAQ: NVDA), Amazon(NASDAQ: AMZN), and Alphabet(NASDAQ: GOOG) (NASDAQ: GOOGL).

A lot can change in five years, but I believe it’s likely that these three companies could grow larger than Apple in that timeframe.

Image source: Getty Images.

1. Nvidia

Nvidia stands out as the most plausible candidate, trailing Apple by around $100 billion in market valuation. Although this might seem significant, it means Nvidia needs only a 3.5% increase in stock price to surpass Apple. I anticipate Nvidia will establish a significant lead over Apple within the next five years.

Nvidia’s graphics processing units (GPUs) dominate the data center market and are essential for running AI models. The data center investment sector still has much room for growth, with Nvidia forecasting capital expenditures rising from $400 billion in 2024 to $1 trillion by 2028. This projected growth will greatly benefit Nvidia.

Wall Street analysts predict revenue growth of 54% for FY 2026 and 23% for FY 2027 for Nvidia. In contrast, Apple’s growth estimates stand at 4% and 6% for FY 2025 and FY 2026, respectively. Nvidia’s superior growth trajectory could position it as the world’s largest or second-largest company soon.

2. Amazon

Amazon faces a more complex landscape, with tariffs impacting many goods sourced from China. Nevertheless, this is not the key metric for assessing Amazon’s prospects.

Investors should focus on profitability. In Q1, 63% of Amazon’s operating profits came from its cloud computing division, Amazon Web Services (AWS). This segment displayed impressive growth, with a 17% increase in revenue and a 23% rise in operating profits.

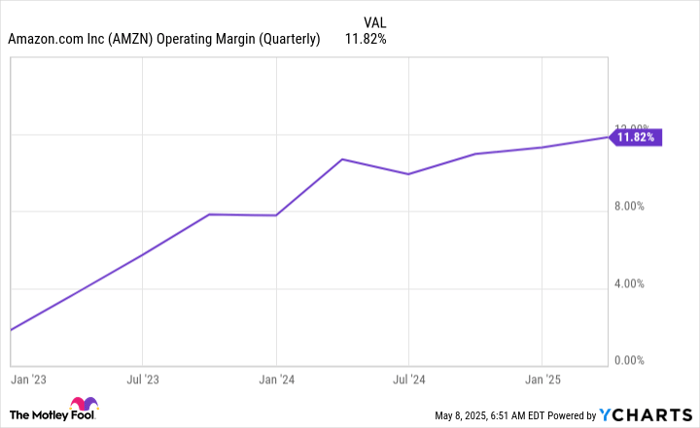

Amazon as a whole saw a 9% year-over-year increase in revenue and a 20% surge in operating profits. This trend is likely to persist as Amazon’s high-margin businesses outpace some of its larger divisions with lower margins. Consequently, Amazon’s operating margins are gradually improving.

AMZN Operating Margin (Quarterly) data by YCharts

This robust growth rate surpasses Apple’s, positioning Amazon well to potentially outpace Apple over the next five years.

AMZN Operating Income (Quarterly YoY Growth) data by YCharts

3. Alphabet

Last on the list is Alphabet, which has recently faced challenges, including being found guilty of running an illegal monopoly related to its Google search engine and advertising business. Eddy Cue, Apple’s senior vice president of services, testified that AI search engines might eventually replace traditional search products like Google.

This news caused Alphabet’s stock to decline but highlights issues already acknowledged by investors. Alphabet is preparing for these shifts by integrating AI-powered summaries at the top of Google search results. Additionally, Cue noted that Apple plans to include AI search options, reducing Alphabet’s need to pay Apple $20 billion as a default search engine.

If Alphabet retains that $20 billion, it could significantly benefit its profit margins. Even now, Alphabet already generates more profit than Apple; if the profit-sharing arrangement changes, Alphabet’s financials will further improve.

AAPL Net Income (TTM) data by YCharts

Although Alphabet faces risks regarding potential regulatory actions and competition in the AI space, if it navigates these challenges successfully, it has a strong possibility of surpassing Apple in valuation.

Conclusion

In summary, while Apple remains a formidable player, both Nvidia and Amazon present compelling cases for growth that may outpace Apple in the coming years. Alphabet, with its own set of risks and opportunities, also remains a noteworthy contender.

The views and opinions expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.