RTX Corp. Shows Promising Growth Amid Defense and Aerospace Developments

RTX Corp. announced that its PhantomStrike radar successfully completed its first flight test in Ontario, CA. This new radar can track multiple airborne targets and provides high-resolution terrain mapping, showcasing its advanced capabilities.

As the industry’s first fully air-cooled, fire-control radar designed for long-range threat detection, this product is priced nearly half of its traditional counterparts. Given the current state of the global threat environment, this announcement could attract significant attention from defense investors, encouraging them to consider adding RTX to their portfolios.

Before making any investment decisions, it’s crucial for investors to examine RTX’s recent share price trends, growth prospects, and any potential risks. Analyzing these factors can provide a more well-rounded perspective.

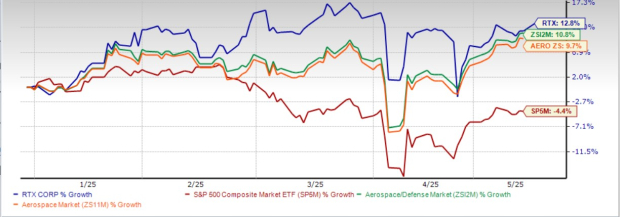

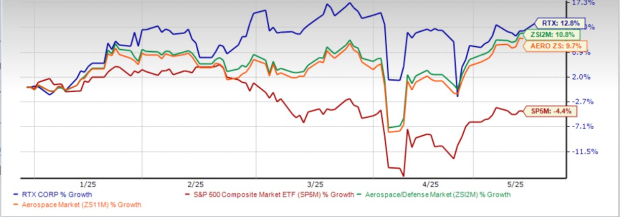

RTX Outperforms Industry, Sector & S&P500

RTX’s shares have increased by 12.8% year-to-date, outperforming the Zacks Aerospace-Defense industry growth of 10.8% and the broader Zacks Aerospace sector, which saw 9.7% growth. Furthermore, RTX has outshined the S&P 500, which has experienced a decline of 4.4% during the same period.

Image Source: Zacks Investment Research

Other defense firms like The Boeing Company (BA) and Leidos Holdings (LDOS) have also exhibited strong performances, with shares climbing 12% and 8.4%, respectively, year-to-date.

What Pushed RTX Stock Up?

Growing global air traffic has bolstered commercial OEM and aftermarket sales for RTX, enhancing investor confidence reflected in its strong performance. The Collins Aerospace segment alone reported an 8% increase in first-quarter 2025 revenues compared to the previous year, driven partly by a 13% rise in commercial aftermarket sales.

Additionally, the Pratt & Whitney unit experienced a 14% jump in first-quarter sales, thanks to a 28% increase in commercial aftermarket sales and a 3% rise in commercial OEM. The strong volume and favorable mix across large commercial engines contributed to these gains, showcasing RTX’s solid footing in the commercial aerospace sector.

Can RTX Stock Hold on to Its Winning Streak?

The outlook for the commercial aerospace market appears optimistic. The International Air Transport Association reported in December 2024 that global passenger traffic is expected to grow at an average annual rate of 3.8% over the next 20 years, adding over 4.1 billion new passenger journeys by 2043.

This predicted growth in air travel should boost demand for new aircraft, supporting sales for Boeing’s commercial airplane segment as well as RTX’s commercial OEM and aftermarket sales. Concurrently, ongoing geopolitical tensions and global security challenges are likely to maintain a strong demand for defense solutions. RTX and LDOS, recognized U.S. defense contractors, are well-positioned to benefit from these trends. As of March 31, 2025, RTX’s defense backlog stood at $92 billion, underscoring its long-term growth potential.

The Zacks Consensus Estimate predicts a long-term earnings growth rate of 9.3% for RTX.

Next, let’s examine near-term earnings and sales estimates for RTX.

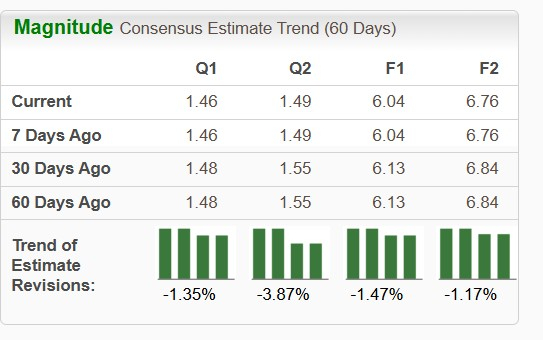

RTX’s Estimates

The Zacks Consensus Estimate for second-quarter and full-year 2025 revenues indicates solid growth of 4.9% and 4.2%, respectively, compared to the previous year. Earnings estimates for 2026 also suggest improvements of 5.8% and 11.9% from the 2025 figures.

However, a downward revision in the company’s near-term earnings estimate over the past 60 days points to a decline in investor confidence.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Risks to Consider Before Choosing RTX

Despite the growth possibilities, certain risks come with investing in RTX stock. A significant challenge facing companies in the commercial aerospace sector, including RTX, is the ongoing supply-chain issues.

Disruptions that began during the COVID pandemic continue to hinder global trade and affect the aerospace industry. According to the International Air Transport Association’s December 2024 report, severe supply-chain issues are expected to hinder the aviation sector into 2025. This may affect the ability of aerospace-defense companies like RTX, Boeing, and Leidos to deliver products on time.

Furthermore, uncertainties from new U.S. import tariffs and retaliatory measures from other countries may negatively impact RTX’s 2025 operational outlook and cash flows.

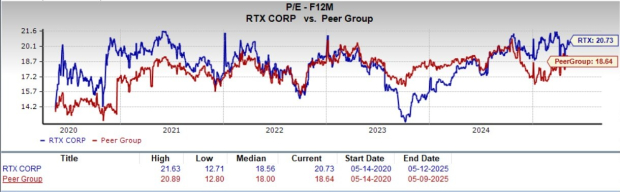

RTX Trading at a Premium

When it comes to valuation, RTX’s forward 12-month price-to-earnings (P/E) ratio stands at 20.73X, representing a premium over its peer group’s average of 18.64X. This indicates that investors are paying a higher price for RTX relative to expected earnings growth compared to its peer group. Furthermore, this forward P/E is above its five-year median value of 18.56.

Image Source: Zacks Investment Research

Should You Buy RTX Now?

Investors considering RTX stock might want to await a more favorable entry point before proceeding. Assessing both the strengths and challenges will be key to forming a well-rounded investment strategy.

# Zacks Insights: Evaluating Stock Performance Amid Earnings Revisions

Investors should approach this Zacks Rank #3 (Hold) stock with caution, given its premium valuation and potential downward adjustments in earnings forecasts. However, stockholders may choose to retain their investments based on the company’s robust sales growth, positive earnings outlook, and ongoing long-term growth prospects.

Potential Investment Strategies

Those already holding this stock may find comfort in its solid market performance and promising growth opportunities, despite the looming concerns over earnings estimates.

Market Overview

This stock’s current position allows for potential assessments concerning both sales figures and market performance. Investors needing further insights into strong buys can refer to Zacks’ complete list of today’s #1 Rank (Strong Buy) stocks here.

For a nominal fee of just $1, interested investors can access Zacks’ portfolio recommendations for a 30-day trial. This low-cost access aims to familiarize potential clients with services that have successfully executed numerous positions, including many yielding significant returns in 2024.

Latest Stock Analysis

To take advantage of Zacks’ in-depth analyses, consider exploring recommended stocks such as:

An article detailing current market conditions was originally published on Zacks Investment Research (read more here).

The views and opinions expressed herein belong to the author and do not necessarily represent those of Nasdaq, Inc.