Top Tech Stocks to Consider Amid Market Volatility

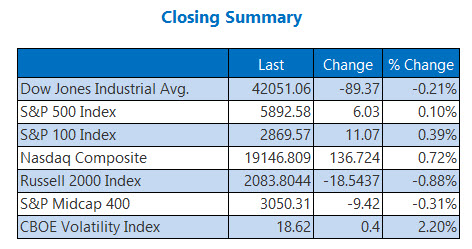

Technology stocks present an unpredictable landscape for investors. Last month, the Nasdaq Composite (NASDAQINDEX: ^IXIC) experienced a significant drop following the announcement of extensive import tariffs, officially entering a bear market. Although it has shown signs of recovery, the index remains down 7% year-to-date.

For those willing to take on some risk, tech companies can provide extraordinary returns. The recent market dip may also offer a favorable opportunity to acquire shares at lower prices. Here are three tech stocks worth considering for your portfolio.

1. The Trade Desk

The Trade Desk (NASDAQ: TTD) operates a demand-side platform catering to digital ad buyers. Brands and agencies collaborate with The Trade Desk to execute digital marketing campaigns across various channels, including display ads, video, social media, and audio.

After exceeding earnings expectations for eight consecutive years, The Trade Desk missed analyst forecasts for 2024. Consequently, its share price fell over 50%, worsening after the Trump administration announced import tariffs on April 2. However, first-quarter results have alleviated some concerns with revenue increasing to $616 million, marking a 25% year-over-year growth. Impressively, customer retention remains above 95%, consistent for 11 years.

The Trade Desk has developed a robust, data-driven platform that now incorporates AI tools to enhance clients’ campaign outcomes. The company possesses a dedicated client base and operates in a burgeoning industry, as global ad spending surpassed $1 trillion last year. With the recent decline in share price, this presents a potent opportunity to invest in a high-growth stock at a discount.

2. ASML

ASML (NASDAQ: ASML) is a Dutch company uniquely positioned as the sole supplier of extreme ultraviolet (EUV) lithography systems, essential for manufacturing cutting-edge semiconductors. The advanced equipment, priced at approximately $380 million each, is crucial for producing efficient semiconductors.

ASML’s production capacity is currently limited by the complexity of creating this machinery. By the end of 2024, it had an order backlog worth 36 billion euros, while sales for that year reached 28.3 billion euros—a modest 2.6% year-over-year increase. Investors remain cautious due to potential competition from China, which is aiming to develop its own EUV lithography equipment.

Nevertheless, any emerging competitors will face significant challenges, as producing EUV lithography systems is no easy task. Even if another firm succeeds, matching ASML’s quality will be a tall order. With semiconductor sales projected to reach $1 trillion by 2030, ASML is well-positioned for continued growth.

3. MercadoLibre

MercadoLibre (NASDAQ: MELI) stands as the largest e-commerce platform in Latin America, operating across 18 countries. Its services include a digital payments platform, Mercado Pago, and an order fulfillment service, Mercado Envios. Similar to Amazon’s logistics services, sellers on MercadoLibre can utilize Mercado Envios for streamlined shipment and fulfillment.

My favorable outlook on MercadoLibre stems from personal experience, having spent several years in Colombia utilizing its services. The user experience is seamless, featuring a vast array of products, akin to Amazon’s offerings. While Amazon leads globally, MercadoLibre dominates in Latin America, holding the number one market share across key regions.

Unlike the previous entries, MercadoLibre has not seen a drop in stock price recently; in fact, it’s approaching an all-time high. Despite its current valuation, the company routinely surpasses expectations, with annual revenue growing by 423% over the past five years, reaching $20.8 billion.

MELI Revenue (Annual) data by YCharts

It is also important to highlight that the e-commerce sector in Latin America remains underdeveloped compared to the U.S. Grand View Research forecasts a compound annual growth rate of 16.7% for Latin America’s e-commerce market through the decade, suggesting it could exceed $1 trillion by 2030. MercadoLibre is poised to take advantage of this expansion.

Though these companies vary significantly, they all provide high-quality products and services backed by strong customer bases. I anticipate that each will outperform the market over the next five years. A sizable investment in one or a diversified holding among all three could significantly enhance your portfolio.