Analyst Targets Suggest Potential Upside for JHMM ETF and Holdings

At ETF Channel, we analyzed the underlying holdings of ETFs within our coverage. We compared the current trading price of each holding to the average 12-month forward target price set by analysts. For the John Hancock Multifactor Mid Cap ETF (Symbol: JHMM), the implied target price based on these holdings is $66.91 per unit.

Currently, JHMM is trading around $59.93 per unit, indicating an expected upside of 11.65% based on the average analyst targets for its underlying assets. Among these holdings, JBT Marel Corp (Symbol: JBTM), Essential Properties Realty Trust Inc (Symbol: EPRT), and Agree Realty Corp. (Symbol: ADC) show particularly notable upside potential.

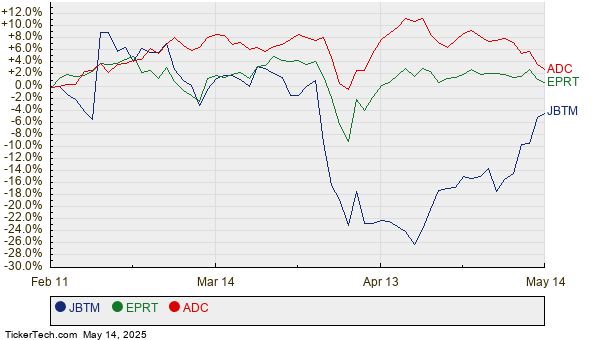

JBT Marel Corp is trading at $118.78 per share, but its average target is 14.22% higher at $135.67. Essential Properties Realty Trust Inc has a recent price of $31.43, with an average target of $35.76, which suggests a 13.79% increase. Furthermore, Agree Realty Corp. is priced at $72.92, with an expected target of $81.97, reflecting a potential upside of 12.41%. The chart below details the twelve-month price history of JBTM, EPRT, and ADC:

A summary of the current analyst target prices is presented in the table below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| John Hancock Multifactor Mid Cap ETF | JHMM | $59.93 | $66.91 | 11.65% |

| JBT Marel Corp | JBTM | $118.78 | $135.67 | 14.22% |

| Essential Properties Realty Trust Inc | EPRT | $31.43 | $35.76 | 13.79% |

| Agree Realty Corp. | ADC | $72.92 | $81.97 | 12.41% |

Investors may wonder if the analysts’ targets are justified or overly optimistic about these stocks’ future trading prices. A higher target relative to the current price can suggest optimism, though it could also precede potential downgrades if assumptions do not hold. Further research into company and industry developments is advisable for investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Explore Additional Resources:

• Preferred Stock Ex-Dividend Calendar

• CLAR Past Earnings

• Institutional Holders of OEH

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.