Tesla’s Robotaxi Service Faces Regulatory Scrutiny Ahead of Launch

Tesla (TSLA), a leader in electric vehicles, is preparing to launch its highly anticipated robotaxi service next month. Customers will use Tesla’s app to book driverless rides, made possible by their Full Self-Driving (FSD) software.

However, before the service goes live, federal safety regulators are intervening. The National Highway Traffic Safety Administration (NHTSA) has initiated an inquiry into Tesla’s FSD system. This investigation will look into the vehicle’s performance in challenging conditions like rain, fog, and glare. The probe stems from four crashes involving the FSD (Supervised) software and is now focused on the upcoming “unsupervised” version that will run the robotaxi service.

While Tesla has tested a supervised version of its robotaxi with employees in Austin and San Francisco, the forthcoming public rollout aims to be fully autonomous, without a backup driver. NHTSA demands that Tesla demonstrate its ability to navigate public roads safely without human intervention. The agency has issued a detailed list of questions and set a June 19 deadline for a response; failing to comply could result in daily fines.

Elon Musk is investing heavily in this autonomous vehicle vision, believing robotaxis could transform transportation and potentially increase Tesla’s value fivefold. However, safety remains paramount, and it remains to be seen if Tesla can fulfill its ambitious commitments.

Competition in the Robotaxi Arena

As Tesla prepares to launch its robotaxi service, competitors like Alphabet (GOOGL) and Baidu (BIDU) are already making strides in this sector. While Tesla’s service is yet to debut, these companies have established a considerable early advantage.

Waymo, a subsidiary of Alphabet, leads the robotaxi market. With extensive real-world testing and strategic partnerships, Waymo currently operates commercial services in four U.S. cities, providing over 250,000 paid rides each week. Last year, Alphabet committed to a $5 billion investment in Waymo over several years.

Baidu is also expanding its Apollo Go robotaxi service, which operates in several Chinese cities, including a fleet of over 400 vehicles in Wuhan. The company plans to test Apollo Go in Europe, with Switzerland set as the starting point by the end of 2025, while also negotiating with PostAuto for an additional launch in Turkey.

Analysis of TSLA’s Stock Performance

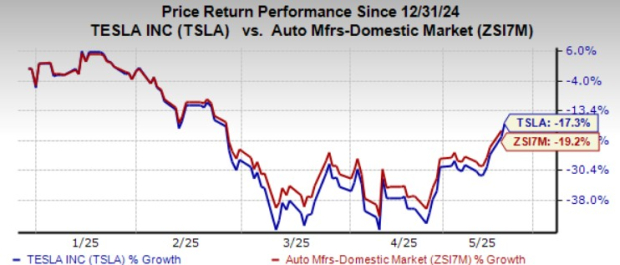

Year to date, Tesla shares have declined approximately 17%, slightly outperforming the broader industry’s drop of 19%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In terms of valuation, TSLA currently has a forward price-to-sales ratio of 10.21, which is above both the industry average and its own five-year average. The stock carries a Value Score of F.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Over the past 60 days, the Zacks Consensus Estimate for Tesla’s earnings has been revised downward.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Currently, Tesla stock carries a Zacks Rank of #5 (Strong Sell).

For those interested in stock analysis, detailed reports are available on Tesla, Baidu, and Alphabet.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.