Alphabet Faces Significant Challenges Amid Market Fluctuations

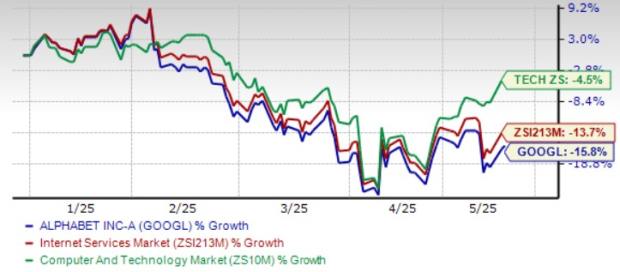

Alphabet GOOGL shares have decreased by 15.8% year-to-date (YTD), significantly underperforming the broader Zacks Computer & Technology sector, which has fallen just 4.5%. This decline can largely be attributed to difficult macroeconomic conditions, slowing cloud growth, increased investments in cloud infrastructure, and rising regulatory challenges.

The company is currently experiencing a capacity shortfall, which is expected to contribute to fluctuations in cloud revenue until new capacity comes online later this year. Alphabet plans to invest approximately $75 billion in capital expenditures by 2025, primarily aimed at enhancing its technical infrastructure, including servers, data centers, and networking. However, the company anticipates that advertising revenue growth will be less robust due to a challenging year-over-year comparison, despite a positive performance in the financial services sector in 2024.

Regulatory concerns are also on the rise. The Department of Justice (DOJ) is challenging GOOGL over allegations of anticompetitive agreements with Apple and other firms that favor its search engine. The DOJ’s proposal to potentially break up Google into separate entities raises alarms, particularly as competition intensifies from AI-driven products like ChatGPT, Grok, DeepSeek, Perplexity, and Meta AI.

Despite these hurdles, Alphabet’s strategy to harness artificial intelligence (AI) for growth is a notable positive factor. AI technology is increasingly integrated into products like Google Search and Google Cloud, serving as a catalyst for revenue growth. Is Alphabet’s emphasis on AI sufficient to enhance its outlook this year? Let’s explore.

GOOGL Stock Performance

Image Source: Zacks Investment Research

Advancements in AI Position GOOGL Favorably

During its Cloud Next 2025 conference in Las Vegas, GOOGL introduced Ironwood, its seventh-generation Tensor Processing Unit (TPU), expected later this year. Additionally, Google Cloud launched its Cloud Wide Area Network (Cloud WAN), which gives enterprises access to its private global fiber network. The company also unveiled Willow, a new quantum chip, alongside its sophisticated AI model, Gemini 2.5, and the cost-efficient Gemini 2.5 Flash model designed for developers.

Alphabet’s efforts to integrate AI in Search are noteworthy. By the end of the first quarter of 2025, Circle to Search reached 250 million devices, with usage rising about 40% during this timeframe. From October 2024 onwards, visual searches using Lens increased by 5 billion monthly, and over 1.5 billion users are now engaging with AI Overview monthly, which offers enhanced reasoning and multimodal capabilities.

In the Cloud sector, Alphabet is reaping benefits from its partnership with NVIDIA NVDA. Google Cloud was the first cloud provider to offer NVIDIA’s B200 and GB200 Blackwell GPUs and will add its next-generation Vera Rubin GPUs. New offerings such as 2.5 Flash, Imagen 3, and Veo 2 are further catching attention, positioning Google Cloud as a preferred provider for enterprises looking to implement AI solutions through tools like the Agent Development Kit and the low-code Agent Designer.

Furthermore, the collaboration between Google and Wiz enhances security measures across multiple cloud platforms, aiding in the prevention of breaches and improving enterprise response times to threats. Wiz boasts an impressive roster of clients, including Amazon AMZN, Microsoft MSFT, and Oracle.

The acquisition of Wiz underscores the increasing significance of Google Cloud in Alphabet’s growth strategy, bolstering its competitiveness against Amazon and Microsoft in the cloud market. As per Synergy Research Group, Amazon held a 29% share of the global cloud infrastructure market in the first quarter of 2025, followed by Microsoft’s Azure at 22%, and Google Cloud at 12%.

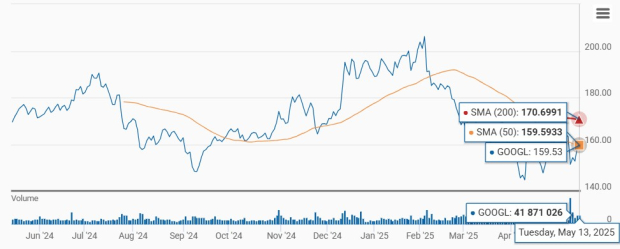

Earnings Estimates for GOOGL Show Positive Trends

The Zacks Consensus Estimate for second-quarter 2025 earnings stands at $2.12 per share, reflecting a 12.17% growth year-over-year, with a slight increase of a couple of cents over the past month.

For 2025, the consensus earnings estimate is $9.43 per share, indicating a 17.29% year-over-year growth, which is up 7% over the last 30 days.

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Alphabet has consistently beaten the Zacks Consensus Estimate in the past four quarters, with an average surprise of 14.64%.

GOOGL Stock Valuation Remains Elevated

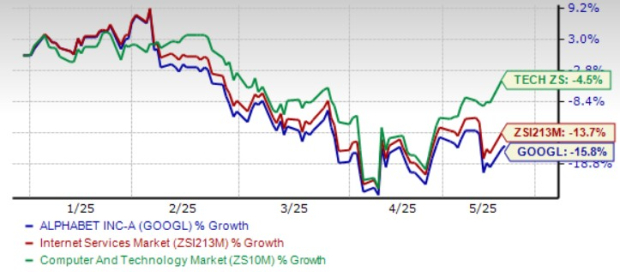

The Value Score of C indicates that Alphabet’s current valuation may be stretched. GOOGL is trading at a forward 12-month Price/Sales ratio of 5.74X, compared to the Zacks Internet Services industry’s average of 4.8X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

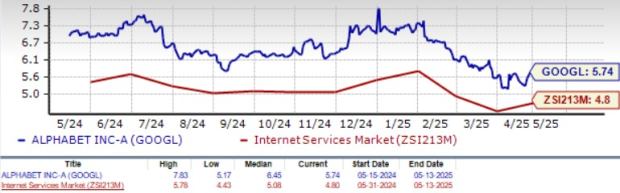

GOOGL shares are currently trading below both the 50-day and 200-day moving averages, suggesting a bearish outlook.

GOOGL Shares Below 50-Day & 200-Day SMAs

Image Source: Zacks Investment Research

Conclusion

Alphabet’s advancements in generative AI and substantial investments in cloud computing may serve as potential growth catalysts. However, these opportunities must be weighed against fierce competition in the cloud market and escalating regulatory pressures. GOOGL’s dominant position in search and strong footprint in cloud services are likely to be key long-term drivers.

Currently, Alphabet has a Zacks Rank #3 (Hold), which suggests that investors may want to wait for a more opportune entry point into the stock.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.