Analysts See Upside Potential for Vanguard Utilities ETF and Key Holdings

Examining the ETFs within our coverage at ETF Channel, we compared the trading prices of individual holdings against their average analyst 12-month forward target prices. For the Vanguard Utilities ETF (Symbol: VPU), we calculated an implied analyst target price of $190.66 per unit based on these underlying assets.

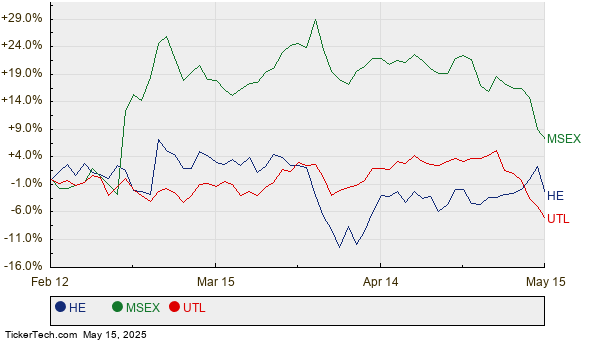

At a recent trading price of approximately $171.33 per unit, analysts project a potential upside of 11.28% for this ETF, considering the average targets of its holdings. Among VPU’s notable holdings, Hawaiian Electric Industries Inc (Symbol: HE), Middlesex Water Co. (Symbol: MSEX), and UNITIL Corp (Symbol: UTL) show significant upside potential relative to their target prices. Specifically, HE, currently priced at $10.33 per share, has an average target of $12.12, indicating a potential increase of 17.38%. MSEX, with a recent price of $55.17, has a target of $62.33, suggesting a 12.98% upside. Similarly, UTL, priced at $52.59, is expected to reach a target price of $59.00, which represents a 12.19% increase. Below is a twelve-month price history chart illustrating the stock performance of HE, MSEX, and UTL:

Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Utilities ETF | VPU | $171.33 | $190.66 | 11.28% |

| Hawaiian Electric Industries Inc | HE | $10.33 | $12.12 | 17.38% |

| Middlesex Water Co. | MSEX | $55.17 | $62.33 | 12.98% |

| UNITIL Corp | UTL | $52.59 | $59.00 | 12.19% |

These targets raise questions: Are analysts justified in their predictions, or do they remain overly optimistic about the future performance of these stocks? Moreover, do analysts have solid reasoning for their target prices, or could they be lagging behind recent developments in the market and industry? A high price target compared to a stock’s trading price often reflects optimism, but it may also foreshadow potential downgrades if the estimates do not align with current realities. Investors should consider these aspects in their research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

See also:

• Funds Holding ATHE

• FSSIU Historical Stock Prices

• GEOS market cap history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.