Toyota Reports Mixed Q4 Earnings Amid Positive Revenue Growth

Toyota (TM) released its fiscal fourth-quarter results for 2025, reporting earnings per share of $3.39. This figure exceeded the Zacks Consensus Estimate of $2.92 but showed a decline from $4.99 in the same period last year. Consolidated revenues reached $81.09 billion, surpassing the consensus expectation of $78.47 billion, and increased from $74.56 billion a year earlier.

As of March 31, 2025, Toyota held cash and cash equivalents (non-financial services) of ¥6.09 trillion ($41.75 billion). Its long-term debt (non-financial services) stood at ¥1.55 trillion ($10.6 billion), a decrease from ¥1.93 trillion recorded a year prior.

Toyota maintains a Zacks Rank #3 (Hold).

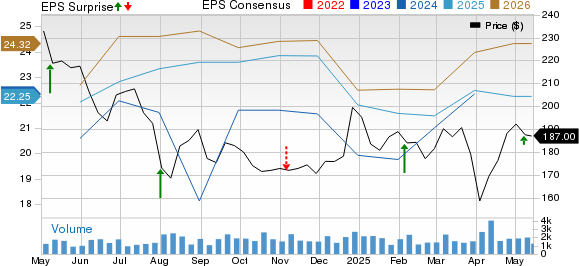

Toyota Motor Corporation Price, Consensus, and EPS Surprise

Toyota Motor Corporation price-consensus-eps-surprise-chart | Toyota Motor Corporation Quote

Segmental Results

The Automotive segment reported net revenues of ¥10.85 trillion ($71.2 billion), marking an 8.2% year-over-year increase and surpassing estimates of ¥10.24 trillion. Operating profit for this segment was ¥866.3 billion ($5.68 billion), down 3.9% from the previous year but above our expectation of ¥837.8 billion.

The Financial Services segment saw net revenues rise 50% year-over-year to ¥1.41 trillion ($9.27 billion), exceeding our forecast of ¥954.2 billion. Operating income climbed to ¥187.2 billion ($1.22 billion), a 22% increase from the fourth quarter of fiscal 2024, and surpassed our estimate of ¥135.5 billion.

All Other businesses generated net revenues of ¥400.7 billion ($2.62 billion) in the quarter, reflecting a 3.8% year-over-year increase and exceeding projections of ¥394.2 billion. This segment achieved an operating profit of ¥56.5 billion ($370 million), up 10.3% year-over-year and above our estimate of ¥46.2 billion.

FY26 Guidance

For fiscal 2026, Toyota anticipates total retail vehicle sales of 11.2 million units, a slight rise from 11.01 million units in fiscal 2025. Expected sales for fiscal 2026 are projected at ¥48.5 trillion, compared to ¥48.03 trillion in fiscal 2025. Operating income is projected to decline to ¥3.8 trillion, marking a 20.8% decrease year-over-year.

Pretax profit is estimated at ¥4.4 trillion, down from ¥6.41 trillion in fiscal 2025. Research and development expenses are expected to be ¥1.37 trillion, compared to ¥1.32 trillion in the previous fiscal year. Capital expenditures are forecasted at ¥2.3 trillion, up from ¥2.13 trillion last year.

Key Auto Releases

General Motors (GM) reported its first-quarter 2025 results on April 29, posting adjusted earnings of $2.78 per share, above the Zacks Consensus Estimate of $2.69, and up from $2.62 a year ago. Revenues totaled $44.02 billion, exceeding expectations of $42.5 billion and surpassing the $43.01 billion recorded a year earlier. GM’s cash and cash equivalents were $20.57 billion as of March 31, 2025, while its long-term automotive debt stood at $13.44 billion.

Ford (F) posted first-quarter 2025 results on May 5, reporting adjusted earnings per share of 14 cents. This figure surpassed the Zacks Consensus Estimate of breakeven earnings but was down from 49 cents a year earlier. Consolidated revenues fell to $40.66 billion, down 5% year-over-year. Ford’s total automotive revenues reached $37.42 billion, exceeding the Zacks Consensus Estimate of $35.48 billion but lower than last year’s $39.89 billion. The company held cash and cash equivalents of $20.9 billion as of March 31, 2025.

Honda (HMC) reported fiscal fourth-quarter 2025 results on May 13, with earnings of 18 cents per share, falling short of the Zacks Consensus Estimate of 72 cents. This also represented a decline from last year’s profit of 99 cents per share. Quarterly revenues of $35.1 billion were below the Zacks Consensus Estimate of $35.6 billion and last year’s figure of $36.5 billion. Honda had cash and cash equivalents of ¥4.53 trillion ($31.04 billion) as of March 31, 2025.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.