Roth Capital Rates Palo Alto Networks Neutral with 9.88% Upside

Fintel reports that on May 15, 2025, Roth Capital initiated coverage of Palo Alto Networks (WBAG:PANW) with a Neutral recommendation.

Analyst Price Forecast Indicates Room for Growth

As of May 6, 2025, the average one-year price target for Palo Alto Networks is €189.93 per share. This forecast varies, ranging from a low of €110.83 to a high of €220.14. The average price target implies a potential increase of 9.88% compared to its latest reported closing price of €172.86 per share.

Financial Projections and Revenue Growth

The projected annual revenue for Palo Alto Networks stands at €9.849 billion, reflecting an increase of 14.92%. Furthermore, the projected annual non-GAAP EPS is estimated to be €6.55.

Recent Fund Sentiment Toward Palo Alto Networks

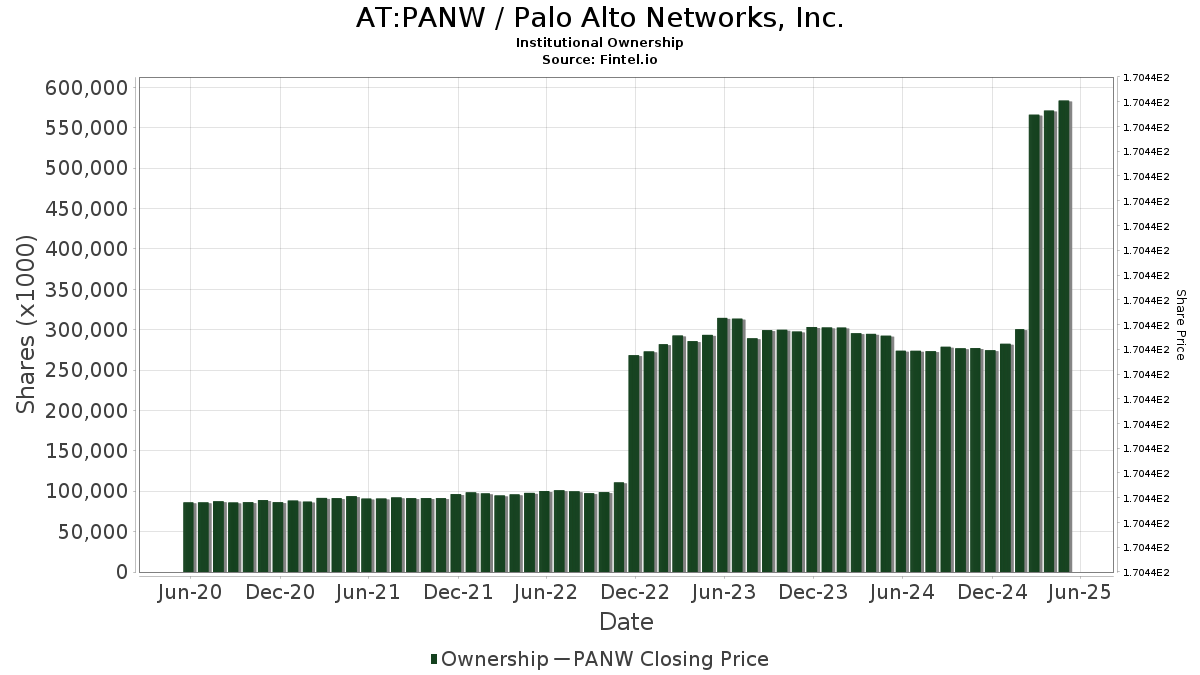

Currently, 3,307 funds or institutions report positions in Palo Alto Networks. This represents an increase of 63 owners, or 1.94%, in the last quarter. The average portfolio weight assigned to PANW across all funds is 0.47%, which signifies a substantial increase of 30.66%. Additionally, total shares owned by institutions rose by 11.97% over the past three months, amounting to 583,554K shares.

Actions of Major Shareholders

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 20,558K shares, making up 3.10% of the company’s total ownership. In its previous filing, the firm reported owning 10,268K shares, indicating a notable increase of 50.05%. The firm also raised its portfolio allocation in PANW by 5.04% over the last quarter.

Similarly, the Vanguard 500 Index Fund Investor Shares (VFINX) possesses 17,708K shares, representing 2.67% ownership. The prior filing indicated an ownership of 8,480K shares, reflecting an increase of 52.11%, with a 5.17% rise in portfolio allocation over the last quarter.

Bank of America holds 16,122K shares for 2.44% ownership. Their previous filing indicates ownership of 16,172K shares, which is a slight decrease of 0.31%. This firm significantly cut its portfolio allocation in PANW by 77.55% over the last quarter.

JPMorgan Chase owns 15,544K shares, representing 2.35% ownership. The last report showed ownership of 14,865K shares, marking an increase of 4.37%. However, they also decreased their portfolio allocation in PANW by 89.85% during the previous quarter.

Geode Capital Management holds 15,005K shares, amounting to 2.27% ownership. In their earlier filing, the firm owned 14,382K shares, signifying a 4.15% increase, but reduced their portfolio allocation in PANW by 0.79% over the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.