UBS Upgrades Caterpillar’s Outlook Amid Mixed Fund Sentiment

Fintel reports that on May 16, 2025, UBS upgraded its outlook for Caterpillar (SNSE:CATCL) from Sell to Neutral.

Fund Sentiment Overview

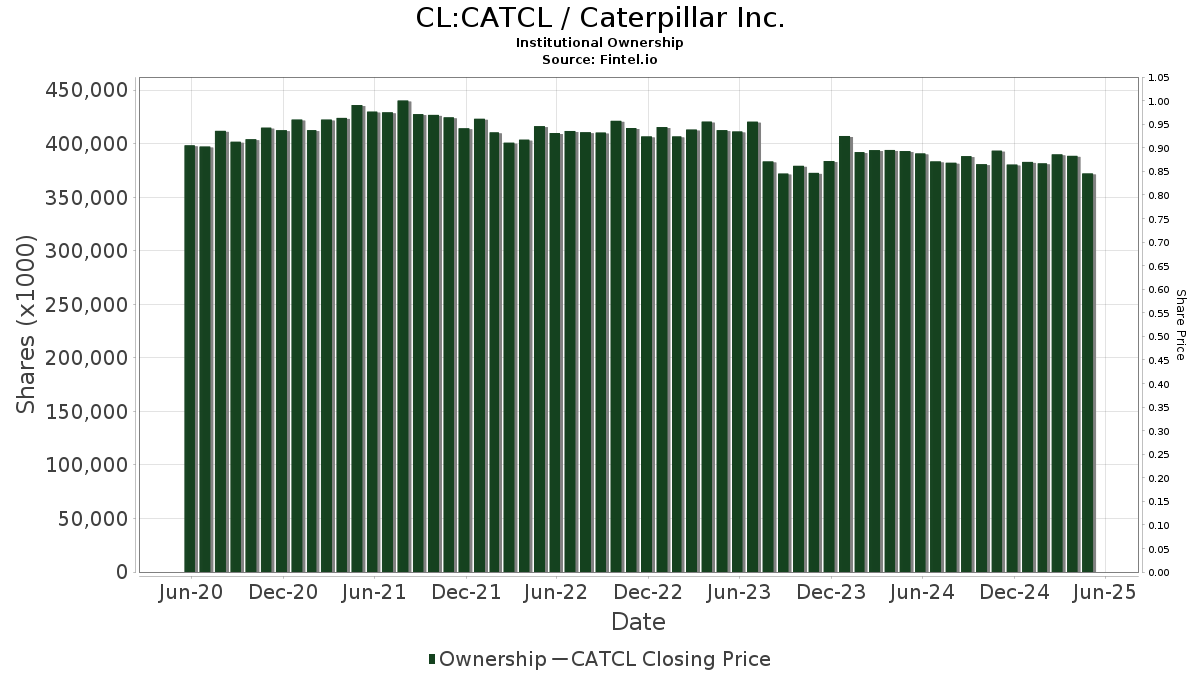

A total of 3,939 funds or institutions are reporting positions in Caterpillar. This figure marks a decrease of 15 owners, or 0.38%, from the previous quarter. The average portfolio weight of all funds dedicated to CATCL stands at 0.40%, which reflects an increase of 8.93%. However, total shares owned by institutions fell by 3.59% in the last three months, resulting in 372,207K shares owned.

Actions by Other Shareholders

State Farm Mutual Automobile Insurance holds 17,669K shares, representing 3.76% ownership of the company. In its prior filing, the firm reported owning 17,734K shares, indicating a decrease of 0.37%. Portfolio allocation in CATCL was reduced by 42.94% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 15,125K shares, contributing to 3.22% ownership. Previous filings indicated ownership of 15,368K shares, which shows a decrease of 1.61%. The portfolio allocation in CATCL was reduced by 10.05% in the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares has 13,069K shares, equivalent to 2.78% ownership. This fund’s previous filing reported 12,700K shares, revealing an increase of 2.82%. However, it also decreased its CATCL allocation by 9.70% last quarter.

Geode Capital Management owns 10,517K shares, representing 2.24% of the company. The firm’s prior ownership was 10,450K shares, reflecting an increase of 0.64%. Despite this, Geode significantly decreased its portfolio allocation in CATCL by 50.90% over the last quarter.

Fisher Asset Management holds 9,210K shares, or 1.96% ownership. The firm increased its holdings from 9,082K shares, which represents an increase of 1.39%. Fisher Asset also slightly increased its portfolio allocation in CATCL by 0.31% last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.