UBS Upgrades Caterpillar to Neutral; Analysts See Price Increase

Fintel reports that on May 16, 2025, UBS upgraded their outlook for Caterpillar (XTRA:CAT1) from Sell to Neutral.

Analyst Price Forecast Indicates Potential Growth

As of May 7, 2025, the average one-year price target for Caterpillar stands at 328.34 €/share. Projections vary with a low of 244.02 € and a high of 398.63 €. This average price target suggests a potential increase of 6.09% from the latest reported closing price of 309.50 € per share.

Projected Revenue and Earnings Per Share

The projected annual revenue for Caterpillar is 69,635MM, reflecting an increase of 10.08%. Additionally, the projected annual non-GAAP EPS is anticipated to be 19.72.

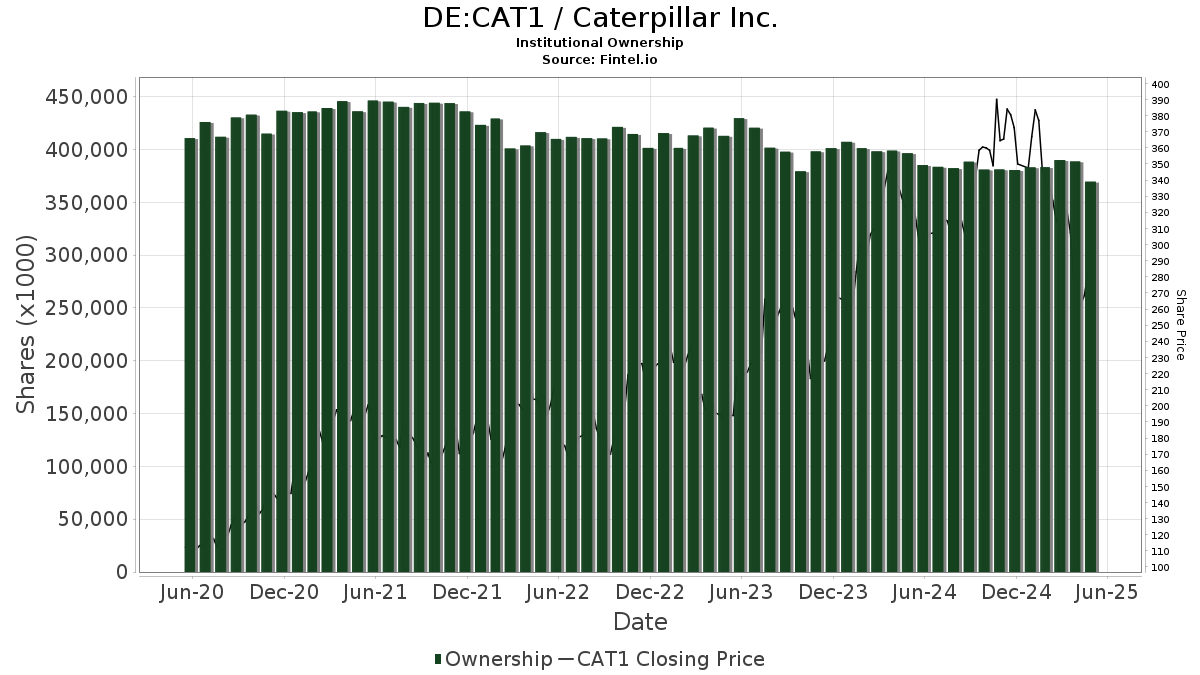

Fund Sentiment Analysis

Currently, there are 3,936 funds or institutions reporting positions in Caterpillar, a decrease of 18 owners or 0.46% over the last quarter. The average portfolio weight for all funds invested in CAT1 has risen to 0.40%, marking an increase of 9.00%. However, total shares owned by institutions decreased by 3.62% in the past three months, totaling 372,061K shares.

Investors’ Movements Explained

State Farm Mutual Automobile Insurance holds 17,669K shares, accounting for 3.76% ownership of Caterpillar. Previously, they reported 17,734K shares, representing a decrease of 0.37%. Their portfolio allocation in CAT1 dropped by 42.94% in the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares currently holds 15,125K shares, equating to 3.22% ownership. This is down from 15,368K shares, reflecting a decrease of 1.61%. Their portfolio allocation in CAT1 was reduced by 10.05% in the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares maintains 13,069K shares, representing 2.78% ownership. In the last filing, they reported 12,700K shares, indicating a 2.82% increase. Their portfolio allocation in CAT1 fell by 9.70% recently.

Geode Capital Management owns 10,517K shares, signifying 2.24% ownership. They previously held 10,450K shares, which shows a 0.64% increase, yet they reduced their portfolio allocation in CAT1 by 50.90% over the last quarter.

Fisher Asset Management holds 9,210K shares, which amounts to 1.96% ownership. Their prior filing indicated 9,082K shares, marking a 1.39% increase. This firm slightly increased its stake in CAT1 by 0.31% in the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.