Evercore ISI Downgrades Park Hotels & Resorts Outlook to In-Line

On May 16, 2025, Evercore ISI Group revised its outlook for Park Hotels & Resorts (BMV:PK), moving it from Outperform to In-Line.

Current Fund Sentiment

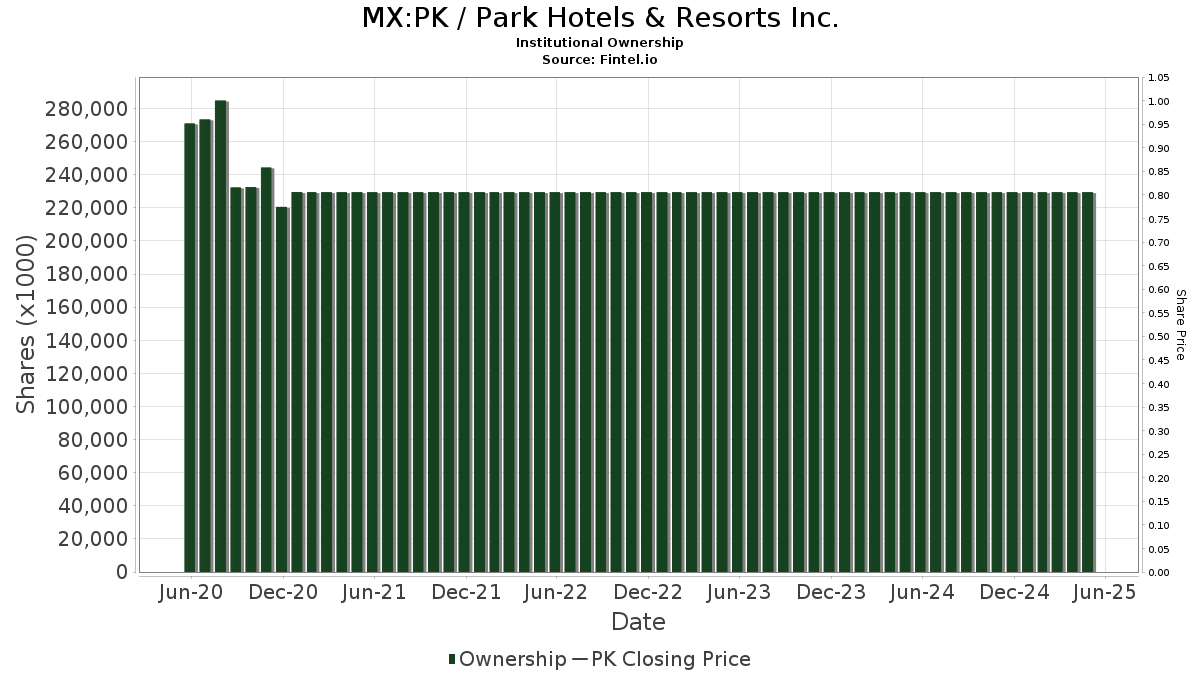

A total of 629 funds or institutions reported positions in Park Hotels & Resorts. This marks a decrease of 50 owners, or 7.36%, in the last quarter. The average portfolio weight for all funds dedicated to PK is 0.12%, reflecting a 5.46% increase. However, total institutional shares owned decreased by 6.01% over the past three months, totaling 229,429K shares.

Shareholder Actions

Donald Smith increased its stake to 11,577K shares, representing 4.91% ownership. This is up from 9,200K shares, indicating a growth of 20.53%. However, the firm’s overall portfolio allocation in PK decreased by 2.20% last quarter.

Bank of America holds 9,561K shares, or 4.05% ownership. Previously, the firm owned 5,685K shares, which is a significant increase of 40.54%. Nonetheless, its portfolio allocation in PK was reduced by 69.34% in the last quarter.

The Vanguard Real Estate Index Fund (VGSIX) holds 8,062K shares, accounting for 3.42% ownership. This is a decrease from 8,291K shares, reflecting a 2.85% reduction in shares owned. The fund decreased its portfolio allocation in PK by 0.99% last quarter.

Arrowstreet Capital, Limited Partnership owns 7,632K shares, which represents 3.23% ownership. The firm increased its shares from 6,692K, a rise of 12.31%, but reduced its portfolio allocation in PK by 12.23% last quarter.

The iShares Core S&P Mid-Cap ETF (IJH) owns 6,700K shares, representing 2.84% ownership. This is an increase from a previous 6,531K shares, reflecting a growth of 2.52%. However, its portfolio allocation in PK was reduced by 1.69% last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.