McKinsey Reports Significant AI Infrastructure Investment Trends Through 2030

Global management consulting firm McKinsey & Company has released a report highlighting key trends in research and development (R&D) and capital expenditure (capex) focused on artificial intelligence (AI) investments over the next five years.

According to McKinsey’s analysis, global spending on AI infrastructure could surge to $6.7 trillion by 2030. Notably, around $3.1 trillion of this investment is expected to go towards chip designers for AI-enhanced data centers.

Current AI Infrastructure Investments by Major Companies

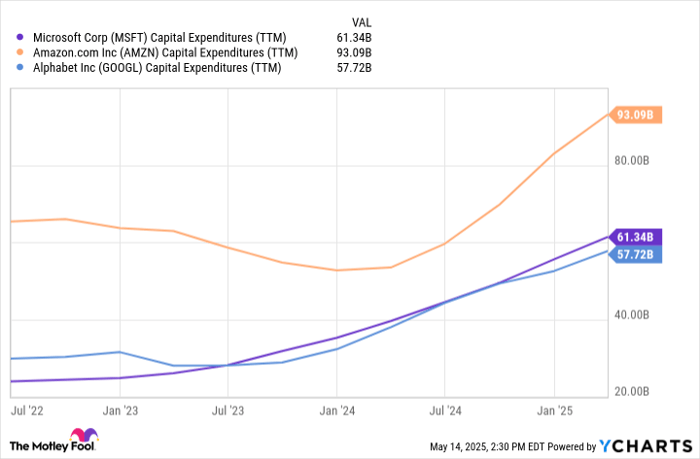

To understand where investors can focus their attention, it is essential to look at leading tech companies making substantial investments in AI infrastructure. The so-called “Magnificent Seven” — including Microsoft, Alphabet, and Amazon — have been allocating billions toward AI. These companies are also collaborating with key players like OpenAI, the creator of ChatGPT, and Anthropic.

Data by YCharts.

The integration of large language models (LLMs) and generative AI into these companies’ operations has accelerated growth, particularly in cybersecurity, productivity software, and cloud infrastructure. This year alone, Microsoft, Alphabet, and Amazon are projected to spend nearly $260 billion on capex, with a significant amount directed toward chips and AI data center infrastructure — aligning with McKinsey’s projections.

Moreover, Meta Platforms has announced an increase in its capex budget for 2025. Similar to its counterparts, Meta has emerged as a significant player in chip purchasing and is exploring custom silicon solutions.

Key Beneficiaries of AI Infrastructure Investments

Focusing on AI chip designers, two prominent picks are Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD). Industry estimates suggest Nvidia commands over 90% of the AI GPU market, while AMD holds a substantial share. Given that major companies rely on both Nvidia and AMD chip architecture, the ongoing capex spending is expected to significantly benefit both entities.

Additionally, Broadcom (NASDAQ: AVGO) is well-positioned to thrive under increasing AI infrastructure spend. The company specializes in providing networking equipment essential for data centers hosting GPU clusters and is also active in developing custom silicon, collaborating with Meta.

Lastly, Taiwan Semiconductor Manufacturing (NYSE: TSM) presents a major growth opportunity as it specializes in the fabrication processes required for chips designed by companies like Nvidia and AMD.

Overall, Nvidia, AMD, Broadcom, and TSMC are crucial players in advancing AI-powered services. With increasing capex commitments from major AI players, these semiconductor stocks are poised for considerable growth in the coming years.

Valuation Trends and Market Sentiment

The chart below shows the forward price-to-earnings (P/E) multiples for Nvidia, Broadcom, AMD, and TSMC.

Data by YCharts.

Recently, there has been a notable decline in the forward P/E ratios for these companies, largely due to uncertainties surrounding President Trump’s tariff policies. While some developments have surfaced, the situation remains dynamic. Many investors are currently adopting a wait-and-see approach regarding the financial guidance from these companies for the upcoming quarter.

As a long-term investor, short-term fluctuations are less concerning. The broader trends driving AI growth are what truly matter. As indicated by McKinsey, investment in AI infrastructure, particularly in chips and data centers, is expected to sustain strong growth for several years.

For these reasons, investors may want to consider capitalizing on any weakness in these chip stocks and prepare for long-term gains.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook, is a board member of The Motley Fool. John Mackey, former CEO of Whole Foods Market, is also involved with The Motley Fool. Adam Spatacco holds positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool also holds long positions in Microsoft.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.