Amazon: A Tariff-Resilient Investment Opportunity

Investors seeking stocks with lower exposure to tariffs may be surprised to find Amazon (NASDAQ: AMZN) on their radar. At first glance, this seems counterintuitive, since online retail remains its largest revenue source. With manufacturing often located in China and other developing nations, it raises the question: how does Amazon seem unaffected by tariffs?

How Amazon’s Business Model Mitigates Tariff Impacts

Amazon is widely recognized for its e-commerce operations, which constitute the bulk of its revenue. However, the company reports operating income primarily from its North American and international segments—areas driven by artificial intelligence (AI) that enhance efficiency. These segments encompass subscriptions, third-party seller services, and digital advertising, all of which grow net sales at a faster pace than its online stores.

While operating income remains positive, Amazon’s reporting may imply that its online stores could be operating at a loss. Regardless, the e-commerce platform can support its more rapidly growing ventures, serving potentially as a loss leader for the company without being significantly affected by tariffs.

It’s important to note that Amazon is not completely immune to tariffs. Many third-party sellers rely heavily on low-cost goods from abroad, meaning tariffs could impact that side of the business. However, sectors like its subscription and advertising services are less sensitive to such changes. Furthermore, the AI-driven Amazon Web Services (AWS), which contributes significantly to operating income, functions independently from the retail market and is largely unaffected by tariffs.

Reviewing Amazon’s Financial Health

Determining the exact impact of tariffs on Amazon will require time. The Trump administration’s announcement of “Liberation Day” on April 2 came just after the end of the company’s first quarter. Some tariff-related announcements during Q1 likely did not substantially affect Amazon’s financial outcomes.

In this context, Amazon reported $156 billion in net sales, marking a 9% increase compared to the previous year. Additionally, net income rose by an impressive 64%, reaching $17 billion, as the company kept its operating expenses well managed. A nearly $3 billion adjustment in the value of available-for-sale debt securities also boosted profits.

Moreover, Amazon anticipates net sales growth of 7% to 11% in Q2, suggesting that tariffs will not broadly impact its financial health.

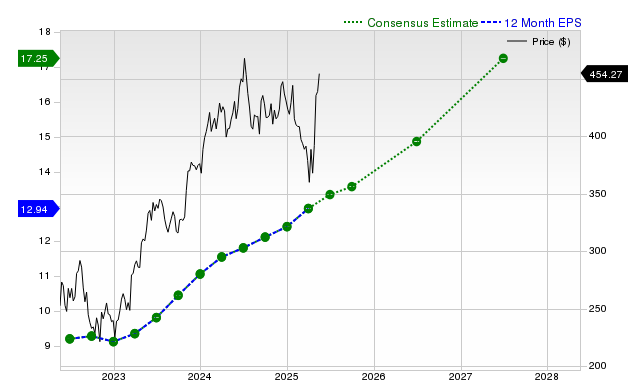

This positive outlook may help explain why Amazon’s stock has begun to rebound from earlier sell-offs. The price-to-earnings (P/E) ratio has climbed from multiyear lows to 33, compared to the S&P 500 average of 28. While this multiple is still notably lower than Amazon’s five-year average P/E ratio of 82, it may present a buying opportunity for investors.

Amazon: A Stock Worth Holding

Despite its significant role in retail, Amazon stock is likely to remain a solid investment regardless of tariff developments. While retail is its main revenue source, it is more of a loss leader that supports faster-growing, less tariff-sensitive sectors.

Furthermore, AWS continues to drive most of Amazon’s operating income, demonstrating that tariffs have minimal impact on the company’s most profitable segments. Coupled with its relatively low valuation, current tariffs should not deter investment in Amazon stock.

The opportunities arising from these insights make Amazon a continued candidate for investment. The market landscape is shifting, but with its diversified revenue streams and strategic positioning, investing in Amazon stock appears astutely advisable.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.