AMD Announces $6 Billion Buyback Amid Competitive GPU Market

The semiconductor industry is often dominated by Nvidia, especially in the high-performance chip sector that includes graphics processing units (GPUs). Over the last two years, Nvidia’s influence in this area has become clear as investors continue to recognize its leadership.

Advanced Micro Devices (NASDAQ: AMD) is gaining traction in the GPU market, but it still operates largely under Nvidia’s shadow. As a result, AMD’s stock performance hasn’t matched Nvidia’s enthusiasm during the ongoing artificial intelligence (AI) boom.

Recent Developments from AMD

AMD made a significant announcement on May 14, when its board approved a $6 billion share repurchase program. This addition brings AMD’s total buyback authorization to $10 billion, combining the new initiative with an existing $4 billion plan.

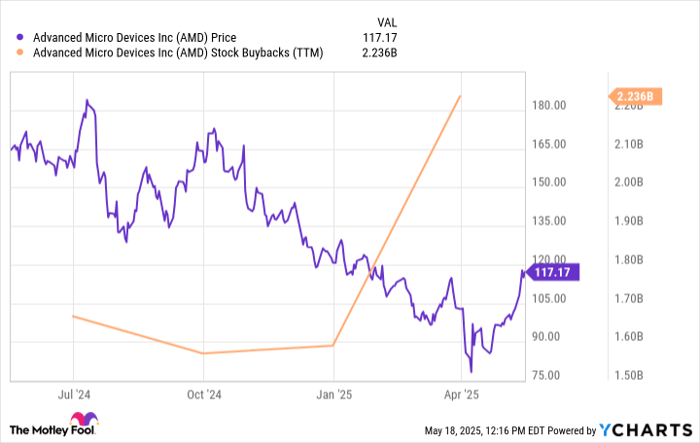

Data by YCharts.

Despite a 30% decline in AMD’s stock over the past year, the company has been ramping up its buyback activity. This dynamic raises questions about investor sentiment and market confidence.

Importance of AMD’s Buyback Program

The financial profile of AMD may appear complex. In the first quarter, it reported $7.4 billion in revenue, reflecting a 36% year-over-year increase. However, the underlying trends tell a more nuanced story.

AMD’s gaming and embedded sectors have shown signs of deceleration, but growth in its data center and client segments has compensated for these losses. Currently, the data center segment constitutes about half of AMD’s total revenue and offers a higher operating margin than both the gaming and client sectors.

While Nvidia holds a first-mover advantage in data center GPUs, it’s important to recognize AMD’s strides in innovation. Over the past year, AMD has secured several notable clients, including Oracle, Microsoft, and Meta Platforms, who have embraced AMD’s MI300 accelerators.

The recent buyback initiative suggests that AMD management believes investors are undervaluing the potential of its AI chip business. As this segment is still in its infancy, the buybacks are a strategic move to instill confidence in AMD’s growth prospects.

Image source: Getty Images.

Is AMD Stock Worth Buying Now?

Despite what may appear to be a high forward price-to-earnings (P/E) ratio, the recent downward trend indicates significant valuation compression that cannot be ignored.

Data by YCharts.

The timing of the new buyback authorization aligns with AMD’s upcoming launch of new GPU architectures later this year. Such strategic moves may signal management’s confidence in robust long-term demand for the upcoming products, positioning the stock as a potential value opportunity.

As AMD continues to roll out successor chip architectures and attract more customers, its data center segment is expected to remain the largest source of sales and profits.

With AMD shares down nearly 50% from their all-time high, investors looking for long-term growth may consider acquiring shares while they are still reasonably priced. The management’s commitment indicates a strong belief in the company’s future.

Considering an Investment in AMD?

Before investing $1,000 in Advanced Micro Devices, keep the following in mind:

The Motley Fool analyst team has recently spotlighted the 10 best stocks for investment, and AMD did not make this list. The stocks highlighted may have significant growth potential in the coming years.

For context, if you had invested $1,000 in Netflix when it was recommended on December 17, 2004, you would now possess $642,582! If you had invested in Nvidia on April 15, 2005, your initial $1,000 would have grown to $829,879!

*Returns as of May 19, 2025

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.