SPDR Portfolio S&P 500 ETF Sees Significant Inflows This Week

In the latest updates on ETFs, the SPDR Portfolio S&P 500 ETF (Symbol: SPLG) has caught attention with an approximate $896.0 million inflow. This represents a 1.3% week-over-week rise in outstanding units, increasing from 963,250,000 to 976,100,000. Among its largest components, Tesla Inc (Symbol: TSLA) is up about 0.1%, Alphabet Inc (Symbol: GOOGL) has increased by 3.1%, while JPMorgan Chase & Co (Symbol: JPM) is down about 0.2%. For the full list of holdings, visit the SPLG Holdings page.

Performance Context and Analysis

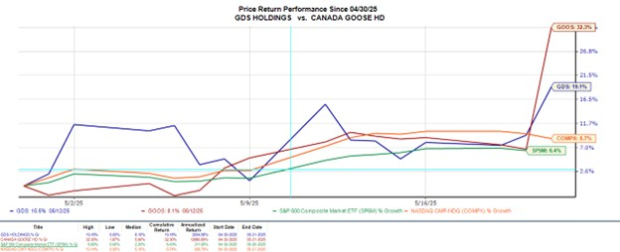

The chart below illustrates the one-year price performance of SPLG against its 200-day moving average:

SPLG’s 52-week low stands at $56.6699 per share, with a high of $72.14. The last recorded trade price was $69.36. Comparing the latest share price to the 200-day moving average can provide valuable insights for technical analysis.

Understanding ETF Dynamics

Exchange-traded funds (ETFs) function similarly to stocks, but investors buy and sell “units” instead of shares. These units can be traded like stocks and created or destroyed to meet investor demand. We track week-over-week changes in shares outstanding to identify ETFs experiencing significant inflows or outflows. The creation of new units necessitates purchasing the underlying holdings, while the destruction of units involves selling those holdings. Consequently, large capital movements can also impact the performance of individual components within ETFs.

![]()

Click here to find out which 9 other ETFs had notable inflows.

Related Information:

- Funds Holding RHT

- CRAI Next Dividend Date

- CALC Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.