Recent Moves by Billionaire Investors: A Deep Dive into AI Stocks

Billionaire investors are once again sharing insights into their investing strategies through their quarterly 13F filings. These reports, mandated by the Securities and Exchange Commission (SEC) for managers overseeing over $100 million in U.S. securities, reveal recent buying and selling activities of these prominent investors.

Why should we pay attention to these 13Fs? They provide valuable context on how these seasoned investors are navigating the current market. Their historical success can offer inspiration for our own investment decisions.

However, it’s essential to remember that not every strategy may align with our risk tolerance or investment goals. Familiarizing ourselves with billionaire strategies can help us tailor our own portfolios.

In the latest filing period, released this month, billionaire Chase Coleman of Tiger Global Management has expanded his holdings in two major artificial intelligence (AI) firms that underwent stock splits last year, both of which have seen double-digit gains since. Let’s explore Coleman’s recent moves to determine if these stocks are worth considering.

Image source: Getty Images.

Coleman’s Background at Tiger Global

Chase Coleman began his career as a research analyst with the legendary investor Julian Robertson at Tiger Management, eventually rising to partner. As a “Tiger Cub,” he established Tiger Global, a firm now managing over $50 billion that emphasizes innovation. By the end of the first quarter, his top holdings included Meta Platforms at a 16% weighting and Microsoft at an 8% weighting.

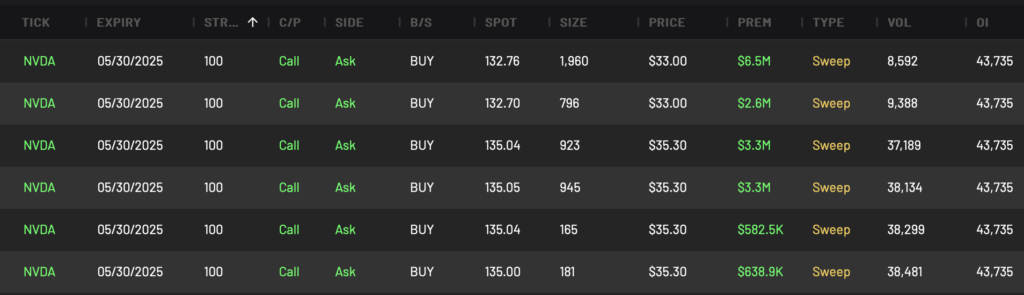

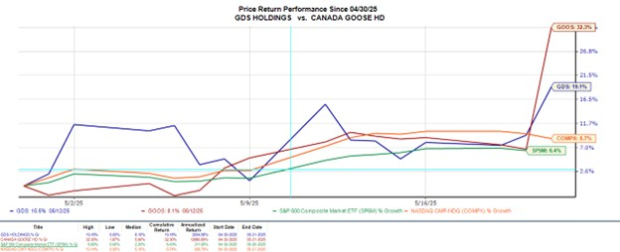

Coleman has recently increased his stakes in two significant AI stocks, both of which completed stock splits last year: Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO). Nvidia completed its stock split in June and has risen 11% since, while Broadcom’s split in July led to a remarkable 34% increase.

Both companies opted for splits after their stock prices exceeded $1,000, making shares more accessible to employees and potential investors. While a stock split does not alter a firm’s fundamentals, it may reflect a company’s confidence in its future performance.

Details of Coleman’s Recent Transactions

In the first quarter of this year, Coleman undertook the following actions:

- He increased his Nvidia holdings by 13%, totaling 10,967,550 shares. Nvidia ranks as his seventh-largest position among 45 holdings.

- His Broadcom position rose by 23%, bringing his total to 2,271,500 shares, which ranks 22nd in his portfolio.

Coleman likely acquired both stocks at favorable valuations, as their forward earnings estimates declined during the first quarter. This decline occurred amid investor concerns regarding the economic implications of President Donald Trump’s import tariffs, affecting growth stocks’ performance overall.

NVDA PE Ratio (Forward) data by YCharts.

Assessing Valuations of Nvidia and Broadcom

Recently, Nvidia and Broadcom’s valuations have increased to 31x and 34x forward earnings estimates, respectively. This uptick stems from optimism concerning the impact of Trump’s tariffs on growth prospects. Despite this, valuations remain reasonable given both firms’ positions and potential within the AI market.

Nvidia has enjoyed significant revenue growth, posting record figures consecutively, while Broadcom reported a 77% surge in AI revenue for the recent quarter.

So, should investors align with Coleman by purchasing these AI stocks? If you are seeking long-term investment opportunities in AI, both Nvidia and Broadcom are promising options.

Their current price levels are accessible, and both companies have demonstrated robust AI growth. Overall, the future landscape for the AI market signals a favorable outlook for these industry leaders.

Final Thoughts on Investment Opportunities

For those who may feel they missed previous opportunities in the stock market, it’s essential to stay informed and ready to act.

Our analyst team periodically identifies “Double Down” Stock recommendations for stocks they believe are on the verge of significant growth. If you’re concerned about having missed out, now may be an appropriate time to invest.

- Nvidia: If you had invested $1,000 when we doubled down in 2009, you would have $351,127!

- Apple: A $1,000 investment when we doubled down in 2008 would now be worth $40,106!

- Netflix: Investing $1,000 when we doubled down in 2004 would yield $642,582!

Currently, we are releasing “Double Down” alerts for three compelling companies. To access these recommendations, consider joining our program.

Randi Zuckerberg, a former director of market development at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adria Cimino has no position in the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms, Microsoft, and Nvidia. The Motley Fool also recommends Broadcom and engages in specific options trading strategies. A disclosure policy is available upon request.

The views expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.