US Stock Markets Decline Amid Trade Concerns and Rising Yields

The S&P 500 Index ($SPX) (SPY) closed down -1.61% on Wednesday, while the Dow Jones Industrials Index ($DOWI) (DIA) dropped -1.91%. The Nasdaq 100 Index ($IUXX) (QQQ) was down -1.34%. June E-mini S&P futures (ESM25) fell -1.66%, and June E-mini Nasdaq futures (NQM25) dropped -1.43%.

Stock indexes plummeted on Wednesday, with the S&P 500 and Nasdaq 100 reaching one-week lows. The decline stemmed from a combination of factors: the ongoing trade war reduced the appeal of US assets for foreign investors, last Friday’s Moody’s downgrade of the US credit rating, and concerns over the negative budget deficit outlook linked to the Republicans’ reconciliation bill. Losses intensified in the afternoon after weak demand for the Treasury’s $16 billion 20-year T-bond auction resulted in soaring bond yields—specifically, the 10-year T-note yield surged +10 basis points to 4.59%.

Higher T-note yields occurred partly due to apprehension surrounding increasing US deficits. On Wednesday morning, House Republicans reached an agreement to raise the SALT deduction from $10,000 to $40,000 per year. If spending cuts fail to offset these tax cuts, the Treasury may need to increase the sale of US debt, potentially pushing bond yields even higher.

Geopolitical risks further contributed to the stock market’s downturn. Reports from CNN indicated that new US intelligence suggests Israel is preparing for a possible strike on Iranian nuclear facilities.

In contrast, the price of Bitcoin (^BTCUSD) rose over +1% to achieve a new record high on Wednesday. This uptick coincided with progress on stablecoin legislation in the US Senate, as a group of Democrats lifted their opposition to it earlier in the week. The bipartisan regulatory bill is currently under discussion, with hopes for a vote this week.

In housing news, US MBA mortgage applications dipped -5.1% in the week ending May 16. The purchase mortgage sub-index fell -5.2%, while the refinancing sub-index was down -5.0%. Notably, the average 30-year fixed mortgage rate increased by +6 basis points to 6.92%, up from 6.85% the previous week.

This week, traders will be focused on potential tariff news and any announcements regarding new trade deals. G-7 finance ministers and central bank governors are meeting from Tuesday to Thursday in Braniff, Canada. On Thursday, initial unemployment claims are expected to rise by +1,000 to 230,000. The May S&P manufacturing PMI is projected to decline -0.3 to 49.9. Additionally, April existing home sales are anticipated to increase +2.0% month-over-month to 4.10 million, while April new home sales are expected to fall -4.7% month-over-month to 690,000.

Markets currently assign a 5% chance for a -25 basis point rate cut at the upcoming FOMC meeting scheduled for June 17-18.

The Q1 earnings reporting season is drawing to a close, with about 90% of S&P 500 companies having reported. Of those, 77% surpassed estimates, marking the highest percentage since Q2 2024. Earnings growth for Q1 stands at +13.1%, significantly higher than the +6.6% anticipated before the season began. However, projections for full-year 2025 corporate profits for the S&P 500 have been adjusted down to +9.4%, from an earlier forecast of +12.5% in January.

Internationally, stock markets exhibited mixed results on Wednesday. The Euro Stoxx 50 closed unchanged, the Shanghai Composite in China rose +0.21%, and Japan’s Nikkei Stock 225 fell -0.61% to a one-and-a-half-week low.

Interest Rates

On Wednesday, June 10-year T-notes (ZNM25) closed down -22.5 ticks, while the 10-year T-note yield increased by +10 basis points to 4.587%. T-notes hit a five-week low amid concerns stemming from a decline in UK gilt prices, which fell to a six-week low after UK April CPI exceeded expectations. Furthermore, worries about unfunded tax cuts in President Trump’s budget could compel the Treasury to increase Treasury debt sales, worsening the burgeoning deficit.

Weak demand for the Treasury’s $16 billion auction of 20-year T-bonds caused T-note losses to accelerate on Wednesday afternoon, with a bid-to-cover ratio of 2.46, significantly lower than the ten-auction average of 2.58.

European government bond yields rose on Wednesday. The 10-year German bund yield increased +4.0 basis points to 2.646%. Meanwhile, the 10-year UK gilt yield reached a six-week high of 4.776%, finishing up +5.4 basis points to 4.757%.

The European Central Bank (ECB), in its biannual Financial Stability Review, cautioned that the “atypical shifts” away from traditional safe havens like the US dollar and Treasuries may signal a potential “fundamental regime change,” suggesting wider impacts on capital flows and the global financial system.

In economic indicators, UK April CPI rose +3.5% year-over-year, outperforming the expected +3.3% increase, marking the quickest pace of growth in 15 months. Core CPI also beat predictions, rising +3.8% year-over-year compared to expectations of +3.6%.

Swaps currently indicate a 93% likelihood of a -25 basis point rate cut by the ECB at its June 5 policy meeting.

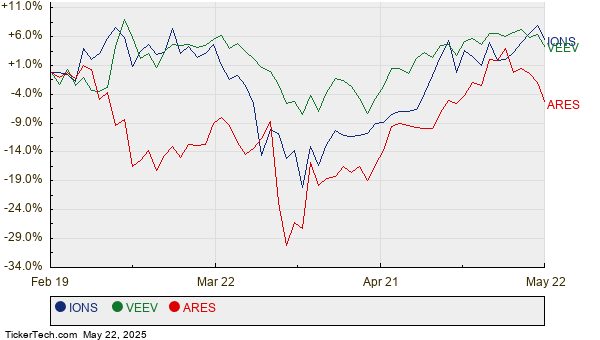

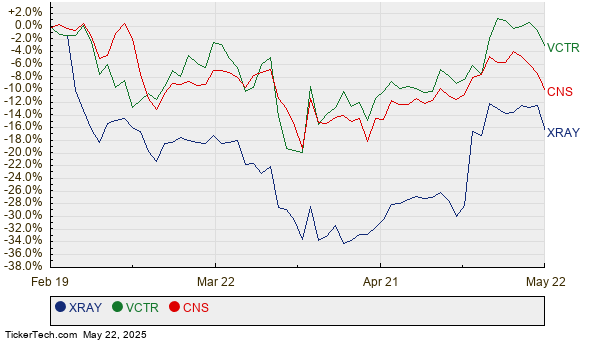

US Stock Movers

On Wednesday, shares of credit reporting companies dropped following concerns raised by FHFA Director Pulte regarding the cost of some credit reports. Fair Isaac (FICO) led the declines, closing down more than -15%. TransUnion (TRU) dropped over -9%, and Equifax (EFX) fell more than -7%.

Palo Alto Networks (PANW) witnessed a decline of over -6% after projecting Q4 next-generation security ARR at $5.52 billion to $5.57 billion, slightly below analyst expectations of $5.57 billion. VF Corp (VFC) fell more than -16% after predicting a larger-than-expected Q1 adjusted operating loss ranging from -$110 million to -$125 million, compared to a forecast loss of -$73.1 million.

UnitedHealth Group (UNH) decreased more than -5% in the Dow Jones due to allegations of secretly paying nursing homes to limit hospital transfers for sick residents. Moderna (MRNA) fell over -7% after voluntarily withdrawing its application for regulatory approval of a combined Covid and flu vaccine for individuals aged 50 and older.

Target Corp (TGT) saw a decline of over -5% after reporting a 3.8% drop in Q1 comparable sales, significantly worse than the consensus estimate of -1.94%. Target also revised its 2026 adjusted EPS forecast down to a range of $7.00 to $9.00, compared to a prior estimate of $8.80 to $9.80.

Take-Two Interactive Software (TTWO) fell more than -4% after announcing a public offering of 4.75 million shares at $225 each. Meanwhile, Alphabet (GOOGL) rose over +2% after analysts indicated an AI event alleviated fears regarding competitive pressures.

Dycom Industries (DY) gained over +14% after reporting Q1 contract revenue of $1.26 billion, surpassing the consensus estimate of $1.20 billion. Also, L3Harris Technologies (LHX) rose +0.77% after Indiana Senator Banks noted the company’s involvement in developing the “Golden Dome” missile defense shield.

Earnings Reports (May 22, 2025)

Companies reporting earnings include: Analog Devices Inc (ADI), Autodesk Inc (ADSK), Copart Inc (CPRT), Deckers Outdoor Corp (DECK), Intuit Inc (INTU), Ralph Lauren Corp (RL), Ross Stores Inc (ROST), Williams-Sonoma Inc (WSM), and Workday Inc (WDAY).

On the date of publication, Rich Asplund did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.