Analog Devices Set to Report Strong Q2 FY’25 Earnings This May

Analog Devices (NASDAQ:ADI) is preparing to report its Q2 FY’25 earnings on Thursday, May 22. Analysts estimate revenues of $2.51 billion for the quarter, representing a 16% increase year-over-year. Projected earnings are expected to reach approximately $1.70 per share, up from $1.40 in the same period last year. The semiconductor market appears to be recovering, with expectations of rising demand from the industrial and automotive sectors, as well as increased need from data centers. Moreover, gross margins are likely to improve due to enhanced volume and reduced inventory pressures.

The company currently has a market capitalization of $113 billion. Over the past twelve months, it recorded revenue of $9.3 billion, showcasing operational profitability with $2.0 billion in operating profits and a net income of $1.6 billion.

Reviewing Historical Earnings Reactions

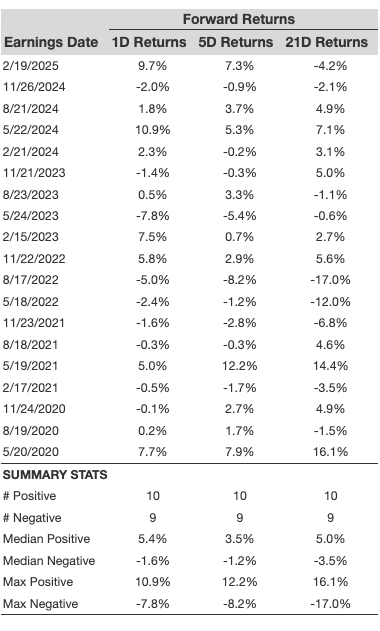

In examining Analog Devices’ historical performance following earnings reports, it is notable that over the last five years, there have been 19 recorded data points, yielding 10 positive and 9 negative one-day returns. This translates to positive returns approximately 53% of the time. When looking solely at the last three years, this percentage rises to 64%. The median of the 10 positive returns stands at 5.4%, while the median for the 9 negative returns is -1.6%.

The following table provides additional data on observed 5-day and 21-day returns following earnings announcements.

This analysis suggests that there is a slightly greater likelihood of an upward movement in stock price after the earnings report. However, it is important to note that stocks can experience sharp declines—20%, 30%, or even 50%—during market downturns, and no stock is immune to such volatility. Understanding how low the ADI stock price could drop in a market crash is crucial for investors.

Understanding Correlations in Returns

A prudent investment strategy involves analyzing the correlation between short-term and medium-term returns after earnings announcements. By identifying a pair with the strongest correlation, a trader can execute trades accordingly. For instance, if 1-day and 5-day returns show high correlation, a trader could opt to take a long position for the next five days if the initial post-earnings return is positive. Below is correlation data based on a five-year history versus a more recent three-year history.

Impact of Peer Earnings on Stock Reactions

The performance of peers can also affect stock reactions following earnings reports. Often, the market begins to price in these influences before an earnings announcement. The historical performance data for Analog Devices’ stock after earnings reveals trends compared to peer companies that have reported earlier. This offers insight into how Analog Devices may respond.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.