“`html

NVIDIA Readies for Strong Q1 FY2026 Results Amid Robust Demand

NVIDIA Corporation (NVDA) will report its first-quarter fiscal 2026 results on May 28. The company anticipates revenues of $43 billion (+/-2%) for the quarter. The Zacks Consensus Estimate stands at $42.71 billion, reflecting a remarkable 64% increase from the previous year’s figure.

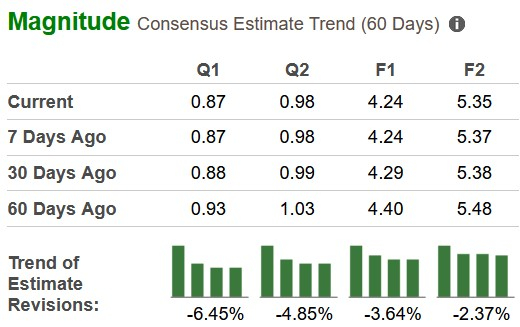

The Zacks Consensus Estimate for quarterly earnings has been adjusted down by a penny to 87 cents per share over the last month. This indicates a 42.6% growth compared to last year’s earnings of 61 cents per share.

Image Source: Zacks Investment Research

NVIDIA has consistently surpassed the Zacks Consensus Estimate for earnings in each of the last four quarters, with an average surprise of 7.9%.

NVIDIA Corporation Price and EPS Surprise

NVIDIA Corporation price-eps-surprise | NVIDIA Corporation Quote

Earnings Whispers for NVIDIA

Currently, the model does not firmly predict an earnings beat for NVIDIA. A combination of a positive earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically increases the odds for an earnings beat, but NVIDIA falls short in this regard. The company currently holds a Zacks Rank of #3 and has an earnings ESP of -5.24%.

Factors Influencing NVIDIA’s Q1 Results

For the first quarter, NVIDIA’s revenue is expected to benefit from ongoing strength in its Datacenter business. The growing trend of cloud-based solutions has shifted demand for chips, particularly within the datacenter market. An increase in hyperscale demand and adoption in the inference market are expected to drive this growth.

The Datacenter business is likely to see heightened demand for generative AI and large language models utilizing GPUs based on NVIDIA’s Hopper and Ampere architectures. Our revenue estimate for this segment stands at $38.5 billion, indicating substantial year-over-year growth of 70.6%.

Moreover, recovery in the Gaming and Professional Visualization sectors is projected to bolster NVIDIA’s first quarter performance. The Gaming segment has shown year-over-year improvement in six of the last seven quarters, as inventory levels stabilize. The revenue estimate for this segment is $3.29 billion, reflecting a 24.4% increase from last year.

In addition, NVIDIA’s Professional Visualization segment has experienced improved performance over the past six quarters. We estimate this segment’s revenue at $567.6 million for the first quarter, representing a 32.9% rise from the same period last year.

The company’s Automotive segment has also shown positive trends, with an estimated revenue of $551.7 million, indicating a year-over-year growth of 67.7%, driven by increasing investments in self-driving and AI cockpit solutions.

NVIDIA Stock Performance & Valuation

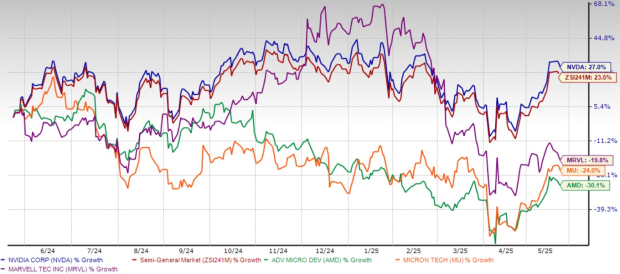

Over the last year, NVIDIA’s shares have shown significant volatility. NVDA stock has gained 27%, outperforming the Zacks Semiconductor – General industry’s growth of 23.5%. Compared to major semiconductor firms such as Advanced Micro Devices (AMD), Micron Technology (MU), and Marvell Technology (MRVL), NVIDIA has fared better, as those stocks have faced declines of 30.1%, 24%, and 19.8%, respectively.

One-Year Price Return Performance

Image Source: Zacks Investment Research

NVIDIA is currently trading with a forward 12-month price-to-sales (P/S) ratio of 15.48X, compared to the industry average of 13.26X, highlighting a stretched valuation.

Image Source: Zacks Investment Research

Additionally, NVDA trades at a premium compared to peers like Advanced Micro Devices, Micron Technology, and Marvell Technology, which have forward P/S multiples of 5.37X, 2.48X, and 5.94X, respectively.

Investment Considerations for NVIDIA

In the previous year, NVIDIA’s revenue growth has been largely propelled by strong demand for chips essential for developing generative AI models. The company holds a dominant position in the generative AI chip market, which has proven invaluable across various industries.

“`

Generative AI Market Expected to Reach $967.6 Billion by 2032

The demand to modernize workflows across various industries is driving interest in generative AI applications. According to a report by Fortune Business Insights, the global generative AI market is projected to reach $967.6 billion by 2032. This market is anticipated to grow at a compound annual growth rate (CAGR) of 39.6% from 2024 to 2032.

Infrastructure Needs for AI Computing

The complexity of generative AI, which necessitates extensive knowledge and significant computational power, means that companies will need to upgrade their network infrastructures significantly. NVIDIA’s AI chips, including the A100, H100, and B100, are preferred options for developing and operating these advanced AI applications. This positions NVIDIA as a leader in the sector, suggesting that the generative AI trend will substantially boost its revenues and market share.

Conclusion: Hold NVDA Stock for Now

NVIDIA has established itself as a dominant player in the semiconductor industry, leveraging its leadership in GPUs while expanding into AI, data centers, and autonomous vehicles. The company’s robust product offerings and continuous innovation present strong investment potential.

Despite these advantages, NVIDIA’s high valuation exposes it to short-term market volatility. For the moment, maintaining a hold on NVDA stock appears to be the prudent strategy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.