Analysts See Upside Potential for iShares Core Dividend ETF

In evaluating the ETFs within our coverage at ETF Channel, we compared each holding’s trading price to its average 12-month forward target price. For the iShares Core Dividend ETF (Symbol: DIVB), the implied analyst target price based on these holdings is $53.27 per unit.

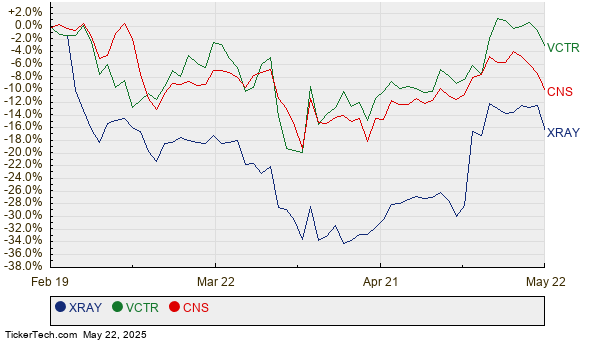

Currently, DIVB is trading around $48.22 per unit, indicating a potential upside of 10.47% according to analysts’ forecasts. Key underlying holdings with significant upside include DENTSPLY SIRONA Inc (Symbol: XRAY), Victory Capital Holdings Inc (Symbol: VCTR), and Cohen & Steers Inc (Symbol: CNS). Specifically, XRAY is trading at $15.83 per share, which is 17.09% below its average target of $18.54. Similarly, VCTR, priced at $61.68, has a target of $72.00, suggesting an upside of 16.73%. Analysts believe that CNS, currently at $77.74, could reach a target price of $90.00, reflecting a potential increase of 15.77%. The chart below illustrates the price performance of XRAY, VCTR, and CNS over the past twelve months:

Here’s a summary table of current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core Dividend ETF | DIVB | $48.22 | $53.27 | 10.47% |

| DENTSPLY SIRONA Inc | XRAY | $15.83 | $18.54 | 17.09% |

| Victory Capital Holdings Inc | VCTR | $61.68 | $72.00 | 16.73% |

| Cohen & Steers Inc | CNS | $77.74 | $90.00 | 15.77% |

Investors may wonder whether analysts’ targets are justified or overly optimistic. A high target price compared to a stock’s trading price may signal strong future potential, yet it could also indicate outdated projections that might lead to target price downgrades. These considerations warrant thorough investor research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Explore More:

• Air Services Other Dividend Stocks

• Funds Holding LBRT

• TSRO Historical Stock Prices

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.