Three AI Stocks Poised for Long-Term Investment Growth

Despite a recent market rebound, certain AI stocks remain attractive for long-term investments. Investors should overlook the prices from a month ago; those opportunities have passed. Waiting for another drop could mean missing out, as a significant decline may not happen soon.

This article highlights three AI stocks that could yield strong profits for investors willing to hold for at least three to five years.

Nvidia: The Leader in AI Investment

Nvidia (NASDAQ: NVDA) has dominated AI investments since early 2023, and this trend shows no signs of changing. The company’s graphics processing units (GPUs) are essential for training AI models. While competition is emerging from custom AI accelerators, Nvidia’s GPUs remain unmatched in computing power and flexibility. This advantage ensures that GPUs will continue to be the preferred option in the foreseeable future.

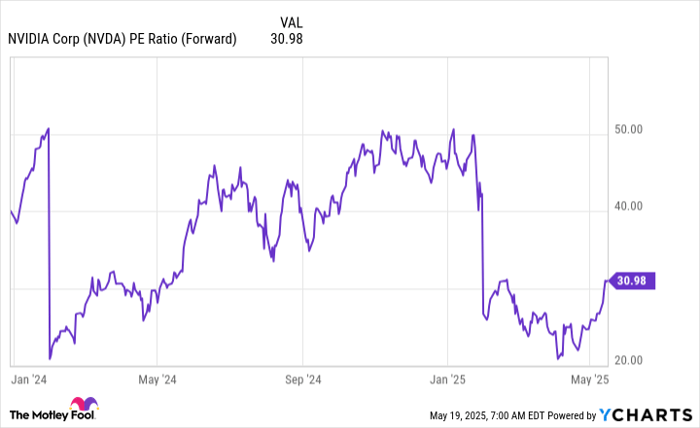

Nvidia stock remains relatively affordable compared to most of 2024, making it a compelling buy for investors.

NVDA PE Ratio (Forward) data by YCharts

In my view, Nvidia remains a strong investment choice. Many investors have profited from holding Nvidia stock throughout 2024, even at higher prices than what we see today.

Taiwan Semiconductor: A Key Industry Player

Taiwan Semiconductor (NYSE: TSM), commonly known as TSMC, is a major supplier of chips, manufacturing components for advanced devices like Nvidia’s GPUs. Notably, TSMC receives orders years in advance, providing valuable insights into chip demand. For instance, its Arizona facility is fully booked for production through 2027, indicating high demand for years to come.

Management recently projected that AI-related chip demand could grow at a 45% compound annual growth rate (CAGR) over the next five years, contributing to an expected near-20% CAGR company-wide. Few companies of TSMC’s size can consistently achieve such growth, yet the market hasn’t fully recognized this potential in TSMC stock.

Currently priced at 21 times forward earnings, TSMC offers a market-average multiple for a company poised for high growth.

TSM PE Ratio (Forward) data by YCharts

Thus, now seems like an opportune time to buy Taiwan Semiconductor stock.

Alphabet: Underrated Amid Challenges

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) represents a more controversial investment, given its current hurdles. Concerns surround how the core Google search engine will compete with rising AI advancements, alongside fears of a potential economic downturn. Additionally, Alphabet faces legal challenges which could lead to a restructuring of its business.

These issues have resulted in an attractive valuation for Alphabet stock, as investors express caution about its future.

GOOG PE Ratio (Forward) data by YCharts

Currently trading at just 17.5 times forward earnings, Alphabet stock is greatly undervalued. Despite risks, I believe this stock presents a worthwhile opportunity.

Alphabet is managing the transition from traditional Google search to AI-enhanced search effectively. Moreover, Google Search revenue increased by 10% year-over-year in Q1, indicating that AI is not yet having a significant negative impact.

While economic conditions may temporarily hinder its performance, history suggests that economic recovery is likely, providing Alphabet with a favorable long-term outlook.

Uncertainties surrounding regulatory actions could also lead to increased shareholder value in the event of a breakup or spinoff. Given these dynamics, I consider Alphabet stock a strong buy opportunity at present.

Important Investment Considerations

For those feeling hesitant about previous investment opportunities, there is still potential for lucrative gains now. Our analysts frequently flag stocks positioned for significant growth. Investors interested in high-performing opportunities may benefit by considering these stocks before it’s too late.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.