Radian Group Inc. Announces $750 Million Share Buyback Program

The board of directors at Radian Group Inc. (RDN) has authorized a new share buyback program aimed at providing additional value to investors. This latest initiative allows for the repurchase of up to $750 million in shares, set to expire on December 31, 2027. With this authorization, Radian’s total buyback authority now stands at approximately $863 million, including about $113 million remaining from the current share repurchase program as of May 20, 2025.

Significance of the New Share Buyback Program

This newly approved buyback program reflects Radian Group’s confidence in its financial strength and capital flexibility. The multi-line insurer upholds a robust balance sheet, exhibiting strong liquidity and cash flow. This financial robustness allows Radian to effectively deploy capital via share buybacks and dividend increases, ultimately enhancing shareholder value. For the three months ending March 31, 2025, Radian repurchased shares totaling $207 million, with approximately $336 million of purchase authority still available under this program.

Quarterly Dividend Declaration

In conjunction with the buyback announcement, the board also approved a quarterly dividend of 25.5 cents per share, scheduled for payment on June 17, 2025, to stockholders of record by June 2. Driven by ongoing financial strength, Radian had previously declared a 4.1% increase in its quarterly dividend during the first quarter of 2025. This marks the sixth consecutive year of dividend increases, with the total having more than doubled over the past five years and showing a six-year compound annual growth rate (CAGR) of 13%. The current dividend yield stands at 3.1%, which surpasses the industry average of 2.5%, making the stock appealing to yield-seeking investors.

Market Position and Outlook

Radian Group is well-positioned to return capital to shareholders while also focusing on growth initiatives through innovative products and high-quality customer service. An improving mortgage insurance portfolio, decreasing claims, a well-performing All Other segment, and a solid capital position should contribute to positive results in the near future.

Stock Price Synopsis

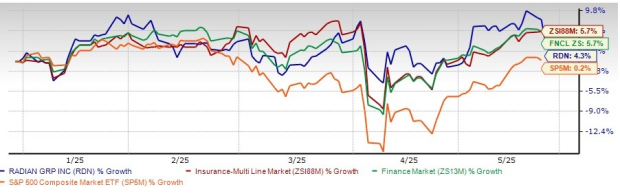

Year-to-date, shares of Radian, carrying a Zacks Rank #4 (Sell), have risen by 4.3%. However, this performance lags behind both the industry and the sector, which have returned 5.7%, while outperforming the Zacks S&P 500 composite’s growth of 0.2%.

Comparative Performance in the Insurance Sector

Similarly, Chubb Limited (CB) approved a 6.6% increase in its dividend rate to $3.88 per share, equivalent to 97 cents per quarter, in May 2025. Additionally, management has authorized a new $5 billion share repurchase program effective July 1, 2025, with the current authorization remaining valid until June 30, 2025. Chubb has consistently demonstrated a strong capital and liquidity position, allowing it to effectively return value to shareholders through dividends and buybacks.

Stocks to Watch

Investors may also consider stocks from the multi-line insurance sector, such as EverQuote, Inc. (EVER) and Horace Mann Educators Corporation (HMN), both holding a Zacks Rank #1 (Strong Buy). Horace Mann has a solid record of surpassing earnings estimates in three of the last four quarters, with an average beat of 24.09%. Year-to-date, shares of HMN are up by 10%, with projected earnings growth of 26.1% and 10.3% for 2025 and 2026, respectively.

EverQuote boasts a strong track record as well, having exceeded earnings estimates in each of the last four quarters, with an average beat of 122.56%. Its shares have appreciated by 13.1% year-to-date, while the consensus estimates predict earnings growth of 32.9% and 20% for 2025 and 2026, respectively.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.