Salesforce Prepares for Q1 Fiscal 2026 Earnings Report

Salesforce CRM is set to announce its first-quarter fiscal 2026 results on May 28. The company forecasts total revenues between $9.71 billion and $9.76 billion, with a midpoint expectation of $9.735 billion. This projected figure represents a 6.6% increase compared to the $9.14 billion reported in the same quarter last year.

Expectations for Earnings and Revenues

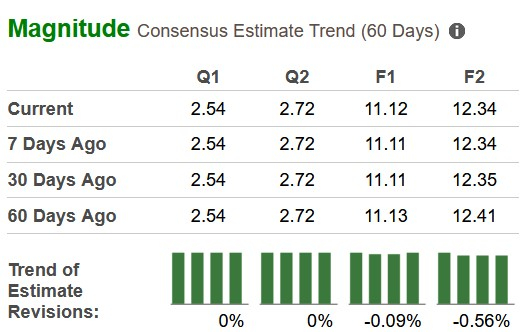

For the fiscal first quarter, Salesforce expects non-GAAP earnings per share to range from $2.53 to $2.55. The consensus estimate for non-GAAP earnings of $2.54 per share remains unchanged over the past two months, indicating a 4.1% year-over-year growth.

Image Source: Zacks Investment Research

Salesforce has surpassed the Zacks Consensus Estimate for earnings in three of the last four quarters, with an average surprise of 4.4%.

Salesforce’s Earnings Performance Metrics

Salesforce Inc. price-eps-surprise | Salesforce Inc. Quote

Earnings Predictions for Salesforce

Our model suggests an earnings beat for Salesforce this quarter. A combination of a positive earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) enhances the likelihood of a favorable earnings report.

CRM’s earnings ESP: The difference between the Most Accurate Estimate ($2.56 per share) and the Zacks Consensus Estimate ($2.54 per share) provides an ESP of +0.76%.

Salesforce’s Zacks Rank: Currently, CRM holds a Zacks Rank of #3.

Key Factors Impacting Q1 Results

Salesforce is well-positioned for strong first-quarter results, largely driven by its focus on digital transformation and cloud solutions. As businesses worldwide engage in digital upgrades, Salesforce’s alignment of product offerings with customer needs likely boosts quarterly revenues.

The increasing demand for generative AI-enabled cloud solutions serves as a significant catalyst for Salesforce’s growth. By incorporating generative AI into its products, the company enhances customer engagement and solidifies its competitive edge in the customer relationship management sector, which should positively impact top-line figures this quarter.

Moreover, Salesforce’s ability to foster relationships with major brands and expand its presence in key markets supports its growth strategy. Their increasing footprint in the public sector could offer additional opportunities for revenue growth this quarter.

Salesforce’s recent acquisitions of Spiff, Own, and Zoomin have significantly diversified its revenue base. These enhancements are likely to increase subscription revenues across core cloud services, expected to show strong performance.

Revenue estimates for Salesforce’s key services are as follows: Sales ($2.14 billion), Service ($2.34 billion), Platform & Other ($1.84 billion), Marketing & Commerce ($1.35 billion), and Data ($1.54 billion). The company also anticipates approximately $9.21 billion in revenue from the Subscription and Support segment and around $518.8 million from Professional Services.

Salesforce’s ongoing cost restructuring efforts should further enhance profitability. The non-GAAP operating margin for fiscal Q4 2025 grew by 170 basis points to 33.1%, mainly due to improved gross margins and cost efficiency, including workforce reductions and less office space.

Salesforce’s Stock Performance and Valuation

Over the past year, Salesforce stock has increased by 1.4%, lagging behind the Zacks Computer – Software industry, which grew by 10.4%. Compared to its peers, including SAP SE, Oracle, and Microsoft, CRM has also underperformed. During this period, SAP rose by 53.1%, Oracle by 26.7%, and Microsoft by 6%.

Annual Price Return Overview

Image Source: Zacks Investment Research

Currently, Salesforce presents a value opportunity for investors. The stock is trading at a forward 12-month price-to-sales ratio of 6.48 compared to the industry average of 9.25.

Image Source: Zacks Investment Research

Salesforce also trades at discounted multiples compared to its competitors, SAP (8.38), Oracle (6.77), and Microsoft (10.87).

Investment Perspective for Salesforce Stock

Salesforce is poised to deliver strong financial results combined with a favorable valuation landscape, making it an attractive prospect for investors.

Salesforce Remains Dominant in CRM Market with Strategic Moves

Salesforce is the leading player in the customer relationship management (CRM) industry, consistently outperforming competitors such as Microsoft, Oracle, and SAP. Gartner’s annual rankings confirm its status year after year. This dominance can be attributed to its extensive product offerings, smooth integrations, and innovative enterprise solutions.

Strategic Acquisitions Boost Market Position

Key acquisitions have significantly bolstered Salesforce’s position in the market. The $27.7 billion acquisition of Slack in 2021 greatly improved its collaboration features, enabling Salesforce to expand as a comprehensive enterprise software provider. Additionally, the recent $1.9 billion acquisition of Own Company in 2024 enhanced its data protection and artificial intelligence (AI) capabilities, aligning with the increasing focus on security and automation in enterprises.

AI Initiatives Strengthen Leadership

Salesforce’s commitment to AI reinforces its leading edge. Following the rollout of Einstein GPT in March 2023, the company has broadened its AI-driven functionalities across its platform. This technology streamlines workflows, enhances automation, and improves customer interactions. As industries increasingly adopt AI, Salesforce stands to gain a competitive advantage.

Positive Outlook Amid Rising IT Spending

The company is well-placed to benefit from the growth in global IT spending. Gartner forecasts that worldwide IT spending will reach $5.61 trillion in 2025, marking a 9.8% year-over-year increase. Spending on enterprise software is anticipated to grow even more rapidly, projected at a 14.2% year-over-year rise. As digital transformation remains a priority for many businesses, Salesforce is positioned to capture a significant share of these expanding budgets.

Conclusion: Hold CRM Stock Ahead of Q1 Results

Salesforce’s leadership in the CRM space, aggressive expansion in AI, and favorable trends in enterprise IT spending provide a strong foundation for continued growth. Given its capacity to post earnings growth despite uncertain macroeconomic conditions, holding onto Salesforce’s stock appears wise.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.