Investors Focus on AI Stocks Amid Promising Financial Returns

Artificial intelligence (AI) is revolutionizing the tech landscape, presenting investors with opportunities for substantial gains. However, as history has shown, not all companies will deliver on their potential. Vigilance is essential when selecting investments in this rapidly evolving sector.

Monitoring the stock picks of billionaire investors may be a valuable strategy. These seasoned professionals typically conduct thorough research into a company’s competitive landscape, risks, and growth potential before making investment decisions.

Insights from Form 13F Filings

By law, billionaire fund managers must disclose their holdings every quarter through Form 13F. The most recent filings indicate that several high-profile investors are still investing in two prominent chip stocks as of the first quarter.

Image source: Getty Images.

1. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM) is the world’s leading chip manufacturer, controlling over 60% of the global foundry market. The company produces chips for top tech firms like Nvidia (NASDAQ: NVDA). The demand for AI-specialized chips in data centers has driven TSMC’s stock price up by 279% in the last five years, with further upside likely.

In the first quarter, notable billionaires such as David Tepper from Appaloosa Management, Stephen Mandel from Lone Pine Capital, and Chase Coleman from Tiger Global Management increased their holdings, demonstrating their confidence in TSMC amid a complex economic environment.

Robust demand for AI chips led to impressive revenue and earnings growth of 35% and 60% year-over-year, respectively. TSMC is actively expanding its production capacity to meet future demand.

The company has also introduced its A14 logic process technology, which marks a significant advancement from its current 2-nanometer (N2) process. This new technology promises a 15% performance increase alongside a 30% reduction in power consumption, with mass production expected to begin in 2028.

However, investors remain cautiously optimistic as the semiconductor industry has historically been cyclical. Despite a generally positive outlook, TSMC faced a 5% revenue drop last quarter due to seasonal fluctuations in smartphone demand and a temporary production setback caused by an earthquake.

Looking ahead, increasing reliance on advanced devices and data centers for AI applications presents a promising path for TSMC. The stock has outperformed the market over the past decade and shows potential for continued success, especially considering forecasts that AI chip sales could double by 2025 and grow at a 40% annual rate through 2028.

Currently, TSMC’s stock trades at 21 times this year’s expected earnings, with analysts predicting a 21% annual earnings growth rate.

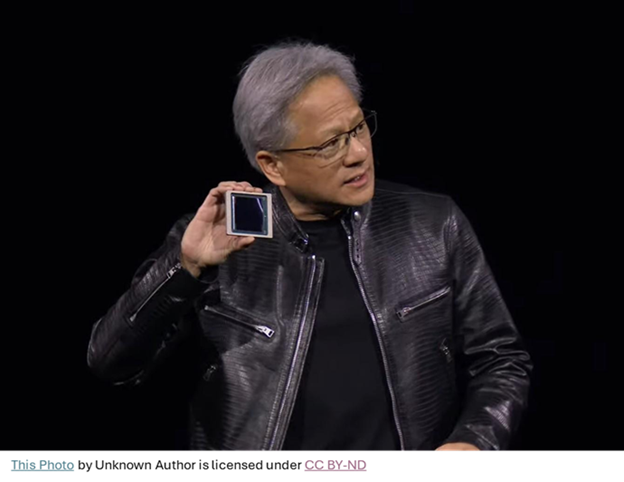

Image source: Nvidia.

2. Nvidia

The optimistic outlook for AI chip sales indirectly benefits Nvidia, whose graphics processing units (GPUs) are regarded as the best in the AI chip market. Despite a remarkable stock price increase of 1,400% over the past five years, some investors still see room for growth. Recently, Chase Coleman added to his stake, while Daniel Loeb from Third Point made a new investment in Nvidia.

After an exceptional year where revenue more than doubled to $130 billion, analysts expect revenue to surge by 53% to nearly $200 billion in the current fiscal year, bolstered by strong prospects for Nvidia’s upcoming chips.

Nvidia’s new Blackwell computing platform, designed specifically for advanced AI workloads, is generating considerable revenue, and demand for its automotive chips for self-driving vehicles is expected to triple this year to $5 billion.

However, one potential risk for Nvidia is that some companies, including Amazon and Alphabet’s Google, are developing their own chips, which could serve as cheaper alternatives. Custom chips might become more efficient for specific tasks, reducing the need for Nvidia’s general-purpose GPUs, which can be quite expensive.

Investors like Coleman and Loeb are banking on the continued necessity for Nvidia’s GPUs in data centers. The company’s software allows customization of its GPUs for various applications. Recent announcements at Computex, including collaborations with Microsoft on advanced AI applications, further solidify Nvidia’s market position.

The introduction of NVLink Fusion enables customers to integrate chips from other manufacturers with Nvidia’s GPUs, broadening its market appeal while maintaining its competitive edge in AI.

Despite a forward price-to-earnings ratio of 30, which is relatively low for a high-growth company expected to increase earnings at a 35% annual rate, Nvidia’s strong market leadership in GPUs positions it for potential significant growth this year.

Conclusion

Investors are closely monitoring the stock performance of companies like Taiwan Semiconductor Manufacturing and Nvidia as AI technology continues to flourish. Both companies could offer substantial growth opportunities in the evolving tech landscape.

# Key Insights Before Investing in Taiwan Semiconductor Manufacturing

Important Considerations Before Buying TSMC Stock

Before you purchase stock in Taiwan Semiconductor Manufacturing, it’s essential to note the following:

Stock Advisor’s Notable Picks

The Motley Fool Stock Advisor analyst team has identified what they consider to be the 10 best stocks for investors currently. Notably, Taiwan Semiconductor Manufacturing is not included in this list. The chosen stocks are expected to deliver significant returns in the upcoming years.

The Value of Historical Beliefs

For instance, consider Netflix, which made this list on December 17, 2004. If you had invested $1,000 at that time based on the recommendation, it would now be worth $644,254!* Similarly, Nvidia earned a spot on April 15, 2005, yielding an investment of $1,000 to a whopping $807,814!*

Understanding Average Returns

It’s crucial to highlight that Stock Advisor has achieved a total average return of 962%, significantly outperforming the S&P 500’s return of 169%. This performance emphasizes the potential impact of carefully selected stocks. To keep updated with the latest top 10 recommendations, consider joining Stock Advisor.

Explore More Investment Opportunities

See the 10 stocks »

*Stock Advisor returns as of May 19, 2025

John Mackey, former CEO of Whole Foods Market and an Amazon subsidiary, serves on The Motley Fool’s board of directors. Additionally, Suzanne Frey, an executive at Alphabet, is also a member of this board. John Ballard holds shares in Nvidia. The Motley Fool has invested in, and recommends, Alphabet, Amazon, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool also suggests the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.