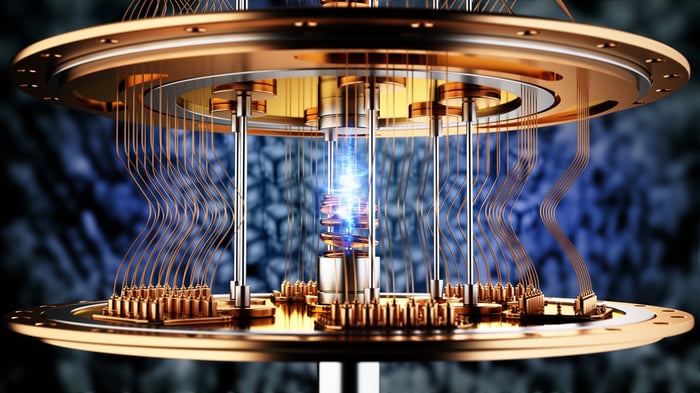

Investing in Quantum Computing: Alphabet and Microsoft Lead the Charge

Quantum computing stands at the forefront of technological innovation, offering potential solutions to some of the world’s hardest problems. As companies race to achieve supremacy in this field, major players are making substantial investments to lead the way.

Among the contenders, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Microsoft (NASDAQ: MSFT) stand out. Their extensive resources position them favorably in the quantum computing arena, which is why they are likely to emerge as leaders in this technological race.

The Challenge Facing Quantum Computing

Alphabet initiated the current investment trend in quantum computing back in December by unveiling its Willow quantum computing chip. The company reported a significant breakthrough by arranging qubits to reduce calculation errors.

The fundamental issue with quantum computing lies in its inherent errors. Unlike traditional computing, which transmits data in binary (0s and 1s) and is less prone to mistakes, quantum computing uses qubits that represent probabilities. While this allows for more complex information transmission, it also introduces potential for errors.

Various competitors have attempted to address these errors with different strategies. Google’s approach entails structuring qubits in a grid formation to minimize errors, while Microsoft claims to have developed a novel state of matter that enhances particle control in its chip, enabling more accurate data processing. The effectiveness of each approach remains to be seen.

What’s clear is that both companies possess the necessary resources to compete vigorously in this field.

Financial Strengths of the Major Players

A notable player among the pure-play investments in quantum computing is IonQ (NYSE: IONQ). IonQ relies on external contracts for funding, generating just over $7.5 million in revenue in the first quarter. For Microsoft and Alphabet, this amount is merely a rounding error, allowing them to allocate significantly greater funding to quantum computing initiatives.

Both companies have consistently generated around $20 billion in free cash flow per quarter over the past three years. Thus, investing approximately $500 million quarterly into quantum computing would be manageable for either company.

MSFT Free Cash Flow (Quarterly) data by YCharts

This financial advantage is also reflected in the ongoing AI arms race, where large tech firms can easily outspend start-ups. While stories of smaller firms outperforming giants exist, the extensive resources and research capabilities required for quantum computing make investing in established companies like Microsoft and Alphabet more appealing.

Another advantage for these tech giants is their robust core businesses, providing them a safety net should their quantum computing efforts not yield desired results. In contrast, a failed project for a start-up could spell disaster, making the caliber of investment required in this sector a risky maneuver that does not align with my strategy.

Investment Considerations for Alphabet

Before investing in Alphabet, it’s important to weigh some factors:

According to analysts, Alphabet is not among the 10 best stocks to buy right now, as identified by the analyst team. They believe that these selected stocks could yield substantial returns in the years to come.

Consider this: if you invested $1,000 in Netflix when it was recommended, your investment would now be worth over $644,254.

Similarly, if you invested $1,000 in Nvidia at the time of its recommendation, you would have approximately $807,814 today.

*Stock Advisor returns as of May 19, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Microsoft.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.