Billionaire Investors Target Two Growth Stocks for Wealth Building

Growth stocks serve as powerful assets for retirement wealth accumulation. These are shares in innovative companies actively pursuing substantial market opportunities that could yield significant returns.

Observing what billionaire fund managers are purchasing can provide valuable investment ideas. Through 13F filings, investors gain insight into the holdings of some of the world’s most successful financiers.

Recent Billionaire Investments

In the most recent quarterly disclosures, billionaires have been acquiring two growth stocks that appear undervalued due to their recent performance and future prospects.

Image source: Getty Images.

1. Uber Technologies

One notable interest among billionaires is in ride-hailing leader Uber Technologies (NYSE: UBER). David Tepper of Appaloosa Management increased his stake significantly, while Bill Ackman of Pershing Square made a notable bold move, acquiring over 30 million shares valued at $2.2 billion by quarter-end.

Uber has shown robust momentum in its core mobility and delivery services. In the first quarter, the company recorded an 18% year-over-year rise in trips and gross bookings on a currency-neutral basis.

Innovation features like Reserve are driving demand in suburban markets. Management reports higher growth rates in these areas compared to urban settings, as more people in suburbs are relying on Uber for daily activities, including dining out. Increased everyday usage positions Uber favorably to benefit from future autonomous ride-hailing services.

With 170 million active monthly users, Uber commands a significant customer base. This allure is enticing partnerships with leading autonomous vehicle makers like Alphabet‘s Waymo and China’s WeRide.

Although regulatory challenges may prolong the rollout of autonomous ride-hailing services, Uber is well-positioned to capitalize on this trend without incurring heavy upfront fleet costs. By partnering with AV manufacturers, Uber can leverage its platform for profit.

The combination of a large customer base and strategic alliances gives Uber a competitive edge, which explains why Ackman and Tepper see considerable value in the stock. Even though shares have recently appreciated and now trade at higher valuations, a forward price-to-earnings ratio of 25 remains attractive, with analysts expecting annualized earnings growth of 23% in the long term.

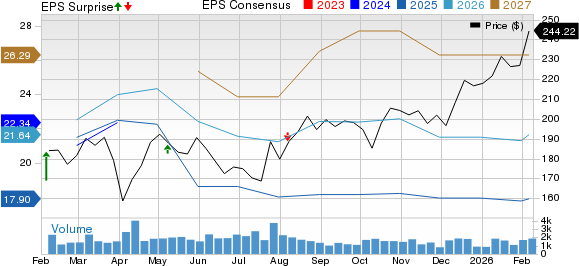

2. PDD Holdings

Another growth stock that gained billionaire interest last quarter is PDD Holdings (NASDAQ: PDD), which is the parent of Pinduoduo in China and Temu. Chase Coleman of Tiger Global Management increased his firm’s stake by 67% during the first quarter.

Pinduoduo is essential in helping Chinese farmers connect with consumers through its direct-to-consumer model, offering attractive deals. Similarly, Temu, launched in Boston in 2022, has quickly become a leading e-commerce platform globally, benefiting from a discount-driven strategy.

The firm’s revenue has surged dramatically—from $15 billion in fiscal 2021 to an impressive $54 billion expected by fiscal 2024. As a tech-oriented company, PDD generates profit mainly from transaction fees and marketing services, achieving a commendable profit margin of 28%.

Unique to PDD is its approach to shopping, allowing customers to form social groups for collective discounts, which encourages repeat business and sustains growth.

Management is focused on long-term growth, often sacrificing short-term profits. The recent reduction in fees for merchants and investments in logistics infrastructure demonstrate this commitment, aimed at extending free shipping options.

However, challenges remain in the competitive e-commerce market. Rival firms like Alibaba may intensify competition, particularly in pricing and selection, while upcoming economic tensions between the U.S. and China could hinder consumer spending, potentially impacting traffic on PDD’s platforms.

Chase Coleman appears to believe that PDD’s current undervaluation sufficiently addresses these risks. The shares trade just under 10 times this year’s earning estimates, reflecting a fair evaluation for a static business, though PDD’s distinct strategy may unlock future growth opportunities not yet apparent in its share price.

Investment Considerations for Uber Technologies

Before investing in Uber Technologies, consider this:

While the Motley Fool analyst team has identified what they believe to be the 10 best stocks for investment currently, Uber Technologies is notably absent from this list. The stocks that made the selection could yield substantial returns over the coming years.

For instance, when Netflix was featured on December 17, 2004, a $1,000 investment would now be worth approximately $644,254!* Similarly, Nvidia‘s inclusion on April 15, 2005, would have turned a $1,000 investment into around $807,814!*

It’s also notable that the average return for the Motley Fool Stock Advisor currently stands at 962%, significantly outperforming the 169% gained by the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of May 19, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Ballard has positions in Uber Technologies. The Motley Fool has positions in and recommends Alphabet and Uber Technologies. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.