Nvidia’s Strategic Partnerships Signal a New Era for AI Development

Editor’s Note: While the market reacts to President Trump’s tariffs, investor Louis Navellier identifies a significant underlying trend.

Dubbed Liberation Day 2.0, Navellier’s analysis suggests that this shift could inject $10 trillion into the economy, create millions of jobs, and ignite a new bull market phase—if investors know where to focus.

What fuels this change? A three-pronged strategy from the president focused on Tax Liberation, Tech Liberation, and Energy Liberation, aimed at revitalizing different sectors of the U.S. economy.

In his upcoming presentation, The Liberation Day Summit, Navellier outlines how he plans to guide investors during this critical transition, including a specific A-rated stock that he believes could yield significant returns in the near future—all accessible at no charge.

Register for the summit now, scheduled for Wednesday, May 28 at 1 p.m. ET, to delve into Navellier’s strategic insights.

To prepare you, Navellier is here today to share insights about these developments starting with an unexpected fashion choice.

Utilizing a quantitative approach he has refined over nearly five decades, this system has helped him identify notable successes like Apple Inc. (AAPL) and Amazon.com, Inc. (AMZN) long before they gained mainstream recognition.

In 2024 alone, this strategy enabled premium members to turn a $7,500 investment into:

- A $2,093 gain on Novo Nordisk

- A $5,500 gain on Axcelis Technologies

- A $7,647 gain on Powell Industries

- A $14,000 gain on YPF

- And an impressive $45,360 gain on Vista Energy.

These outcomes come without engaging in riskier strategies like options or penny stocks.

Notably, attire can reveal much about a person’s intentions and mindset.

This concept often serves as a reminder that appearances can influence perceptions of professionalism.

However, choosing to break with norms can also send strong signals.

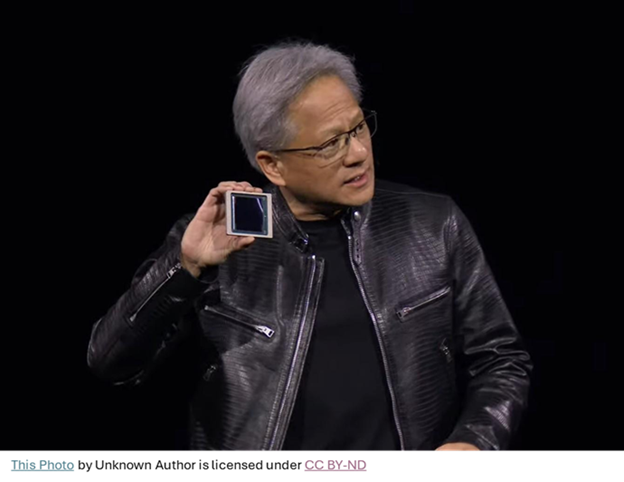

For instance, Nvidia Corp. (NVDA) CEO Jensen Huang typically portrays a casual image in his leather jackets at major events.

Recently, while accompanying President Trump on a trip to the Middle East, Huang notably wore a suit and tie for a meeting with the Saudi Crown Prince.

This decision suggested that significant developments were on the horizon.

Source: YouTube

Behind the scenes, a noteworthy international agreement was forming, paving the way for considerable investment in AI from the Middle East. This development could give Nvidia a new level of global influence.

This article will explore why the Saudi deal, along with two additional catalysts, may permanently reshape the American economy and unlock significant opportunities for investors.

Additionally, I will outline actionable steps you can take, starting Wednesday, May 28, to position yourself for potential gains as AI investments grow under the Trump administration.

Let’s get into the details…

Strategic Partnership Set to Transform the AI Landscape

During his visit, Huang announced a landmark collaboration between Nvidia and Saudi Arabia’s HUMAIN, a cutting-edge AI firm.

This partnership involves Nvidia supplying 18,000 Blackwell chips…

# Nvidia Expands AI Infrastructure in Saudi Arabia Amid Growing Global Demand

Nvidia has announced plans to build a 500-megawatt AI data center in Saudi Arabia, partnering with HUMAIN. This move is part of a broader strategy to position the company as a leader in the global AI infrastructure market.

Jensen Huang, Nvidia’s CEO, emphasized the importance of AI, stating:

AI, like electricity and internet, is essential infrastructure for every nation. Together with HUMAIN, we are building AI infrastructure for the people and companies of Saudi Arabia to realize the bold vision of the Kingdom.

Phased Expansion Plans

The first phase of the project will begin with a significant deployment of Nvidia GPUs. Over the next five years, the plan includes scaling up to several hundred thousand GPUs and establishing “AI factories.” These facilities aim to drive innovation in cloud computing, robotics, and other AI disciplines.

This initiative represents Nvidia’s commitment to becoming a major player in the AI revolution. Saudi Arabia’s efforts to diversify its economy from oil dependency reinforce the strategic significance of this partnership.

Nvidia’s Broader Strategic Moves

Beyond the Saudi Arabian venture, Nvidia has unveiled its new DGX Cloud Lepton service. This offering will enable AI developers to access Nvidia’s AI chips directly via the cloud, potentially solidifying Nvidia’s dominance in the AI sector.

Recent reports indicate that Nvidia is also in advanced discussions to invest in PsiQuantum, a startup focused on creating commercially viable quantum computers. This investment could significantly bolster Nvidia’s position in the emerging quantum computing market.

The Importance of Quantum Computing

Nvidia’s rapid growth in the AI sector comes as the company prepares for future challenges. Although it continues to develop its Blackwell chip and others, there may be limits to transistor miniaturization. Quantum computing represents a potential solution for tomorrow’s computational needs, complementing Nvidia’s current offerings in AI.

By investing in PsiQuantum, Nvidia is strategically positioning itself at the convergence of AI technology and quantum innovation.

Nvidia’s Robust Performance

This year, Nvidia has defied skeptics, demonstrating remarkable growth in earnings, sales, and institutional support. My analytical model has maintained a “Buy” rating for Nvidia throughout this period, reflecting its continuing leadership in the market.

Historically, Nvidia has been a strong performer. Since I recommended it in 2016 when shares were trading at approximately $1 (split-adjusted), investors who followed this guidance have seen impressive returns of around 7,000%.

The Future Outlook

Despite the remarkable growth, Nvidia is still regarded as a strong buy based on my proprietary analysis. The company is poised to sustain its leadership position in the ongoing AI revolution.

A Shift in the Tech Sector

Nvidia’s foray into the Middle East and quantum computing reflects broader economic strategies inspired by recent policy shifts. The administration has been focused on “Tech Liberation,” removing regulatory barriers that encourage innovation in areas like AI and cloud technology.

With over $2 trillion in private capital committed to domestic tech projects, a significant transformation in the American economy is underway, potentially impacting market movements for years to come.

In light of these developments, I will be hosting a summit to further discuss the impact of these economic strategies and highlight companies positioned to benefit from this transformation.

For investors, understanding these trends could translate to substantial opportunities. Strategic positioning today could yield significant benefits in the near future.

Sincerely,

Louis Navellier

Disclosure: As of the date of this email, I own securities in Nvidia Corp. (NVDA).