Market Rally Linked to President Trump’s Economic Strategy

As the market reacts to President Trump’s recent tariffs, investors are focusing on a significant economic strategy dubbed Liberation Day 2.0, which could potentially release up to $10 trillion in stimulus and create millions of jobs.

Overview of the Economic Strategy

This strategy consists of three main elements: Tax Liberation, Tech Liberation, and Energy Liberation. Each aims to invigorate specific sectors of the U.S. economy.

Upcoming Presentation

Investor Louis Navellier will detail his analysis and predictions in a presentation titled The Liberation Day Summit on Wednesday, May 28 at 1 p.m. ET. He will also introduce one specific stock that he believes could yield significant profits for investors.

Market Recovery Insights

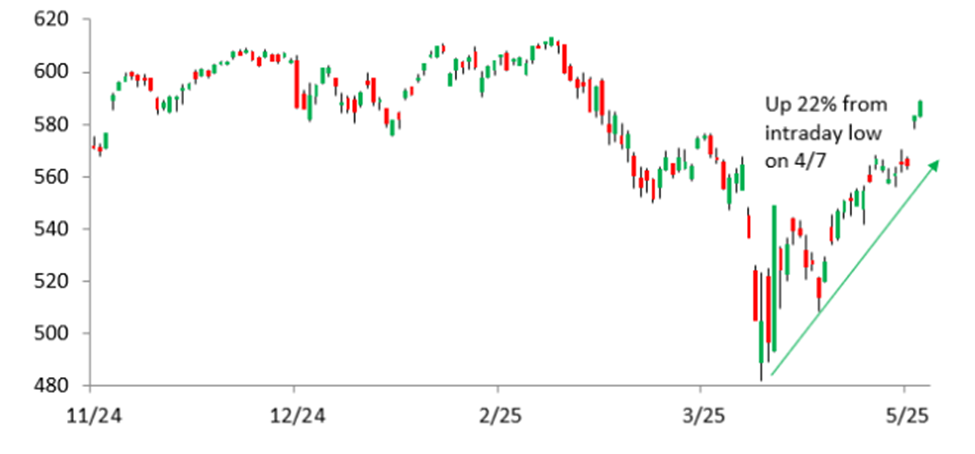

Following the significant drop on April 3, predictions about a rally were discussed. Notably, the S&P 500 declined over 15% year-to-date as of April 8, but recovered these losses in the subsequent 25 trading days, according to Bespoke Investment Group.

Predictions and Market Analysis

Navellier has successfully predicted several political and market developments over the past two years, including Biden’s potential withdrawal from the presidential race and Trump’s return to the White House. He asserts that these anticipations have been validated by unfolding events.

Key Predictions by Louis Navellier

1. Biden’s Withdrawal: In December 2023, Navellier predicted Biden would not reach the 2024 election, anticipating a replacement from California, which turned out to be Kamala Harris.

2. Trump’s Reelection: He forecasted Trump’s victory in 2024 and outlined potential policies aimed at revitalizing American manufacturing and energy sectors.

3. Trade Shifts: Navellier warned of impending tariffs and market volatility when Trump took office. He also projected that these tariffs would lead to negotiations that would favor U.S. workers and ultimately stabilize the market.

Future Projections under Liberation Day 2.0

The current market developments are part of a broader strategy that includes major reforms. The Tax Liberation initiative proposes using tariff revenue to reduce income taxes for Americans earning under $150,000, which may encourage consumer spending and investment.

# U.S. Economic Resurgence: Opportunities in Tech and Energy Sectors

## Significant Financial Commitments

Since the recent election, Big Tech, the U.S. government, and foreign entities have committed over $2 trillion to developments in AI, cryptocurrency, and cloud infrastructure.

## Energy Resource Expansion

The U.S. possesses over $100 trillion in untapped energy and mineral resources. New executive orders aim to reduce regulations on mining and drilling projects, potentially sparking a long-term growth cycle in strategic materials and domestic energy.

## Portfolio Positioning Strategies

Investors are encouraged to consider stocks benefiting from these “Liberation 2.0” policies.

### Recommendation: Powell Industries Inc. (POWL)

In December 2023, I advised my premium members to buy **Powell Industries Inc. (POWL)** for its history of significant earnings surprises. Over the last five quarters, the company achieved surprises of 305.6%, 400%, 233.3%, 130.3%, and 62.5%. Since the recommendation, Powell’s stock has surged with peak gains of 300%.

While large earnings surprises typically don’t lead to massive profits, exposure to the booming AI sector has had a positive impact. Initially not highlighted in the recommendation, Powell’s role in AI data centers became evident by mid-2024, leading the stock to double shortly thereafter.

As AI expands, so does the need for reliable data centers that require customized electrical solutions. Powell also serves major clients in various industries, benefiting from the Tax, Tech, and Energy Liberation policies.

During the second quarter of fiscal year 2025, Powell reported new orders of $249 million, with a backlog of $1.3 billion. Revenue rose 9% year-over-year to $279 million, slightly under analysts’ expectations. Earnings increased by 38% year-over-year to $46 million, surpassing analyst estimates by 10.8%.

Analysts forecast Powell’s revenue for 2025 to reach $1.12 billion, growing from $1.01 billion the previous year, along with earnings per share climbing to $14.17 from $12.29.

Currently, Powell earns a “B” rating in my stock grading system and is considered a good buy under $227.

## Further Insights on Investment Opportunities

Investor interest can extend beyond Powell. I will host a free broadcast on **May 28 at 1 p.m. Eastern**, detailing the “Liberation Day 2.0” investment strategy, including three stocks with higher ratings than Powell.

Historically, my grading system has identified key growth stocks, generating significant gains for members without high-risk strategies.

To learn more, I encourage you to register for the upcoming summit.

### Register Here for Liberation 2.0 Summit

**Sincerely,**

**Louis Navellier**

**Senior Analyst, InvestorPlace**

**Disclosure:** As of this communication, I own shares in Powell Industries Inc. (POWL).