S&P 500 Recovers Strongly Following April Selloff

The offices are closed today for Memorial Day to honor fallen military service members. Customer service will resume tomorrow at 9 a.m. Eastern Time.

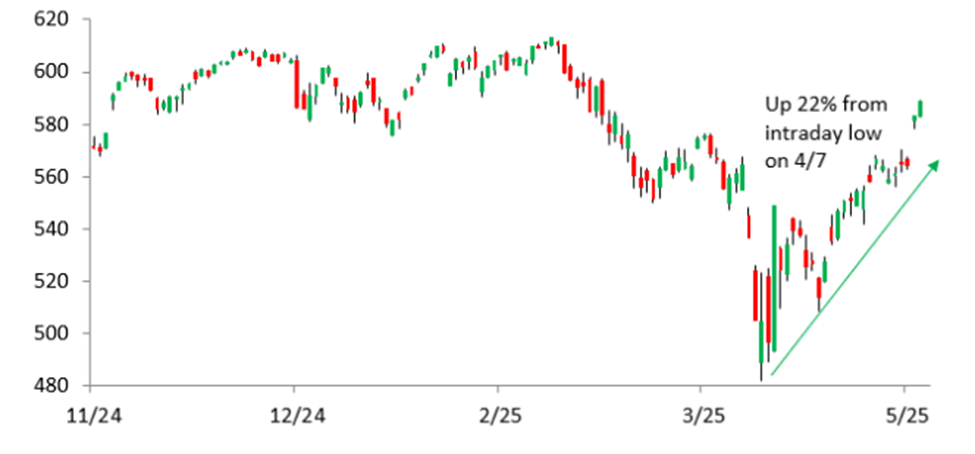

After the April 3 selloff, investor Louis Navellier predicted a strong market rally. Within 25 trading days, the S&P 500 recovered its losses, surprising many on Wall Street but not his subscribers.

Over the past two years, Navellier accurately forecasted:

- Biden would withdraw from the presidential race.

- Trump would win the 2024 presidential election, leading to pro-growth policies.

- The initial “trade panic” would initiate a broader bullish trend.

Navellier has now made a new prediction related to “Liberation Day 2.0,” which he will elaborate on further in today’s essay. He also identified a little-known stock set to benefit from upcoming trends in AI, energy, and infrastructure.

This Wednesday, May 28, Navellier will unveil his complete “Liberation Day 2.0” strategy and three more stocks with high growth potential. Registration for this free event is available online.

Now, I’ll turn it over to Louis for further insights.

Wishing everyone a good Memorial Day and a warm welcome to summer.

Jeff Remsburg

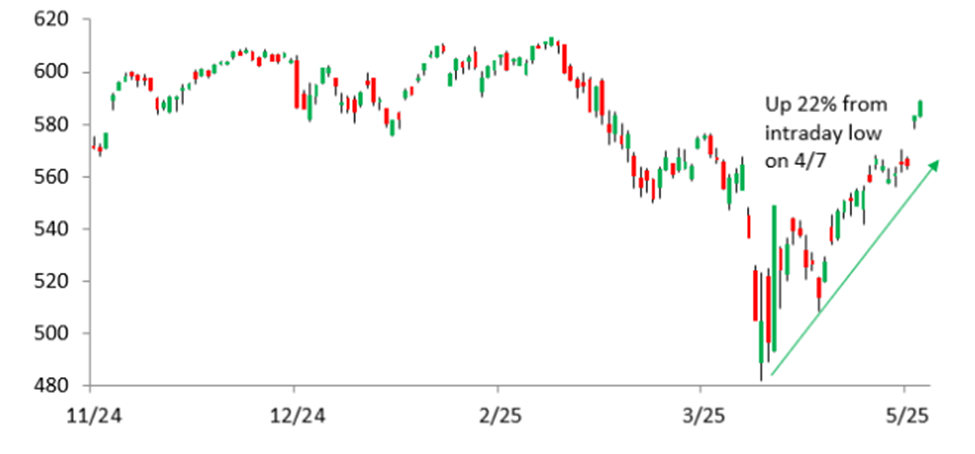

Following the significant “Liberation Day” selloff on April 3, I confidently predicted a major market rally, suggesting that a recovery was imminent once the dust settled.

According to analysis by Bespoke, the S&P 500 was down over 15% year-to-date by April 8. Yet, within the next 25 trading days, it completely recovered.

Source: Bespoke Investment Group

While the media portrayed this rally as unexpected, that interpretation is inaccurate.

Over the past two years, I made three significant predictions: Biden stepping back from candidacy, Trump’s political return, and the transition triggered by trade policies.

Now, I intend to share my next prediction and highlight a specific stock poised to gain from upcoming trends.

Recent Predictions Overview

1. Biden’s Withdrawal: In December 2023, I forecasted that President Biden would not complete the 2024 race. I understand the political landscape well and expected party insiders would not risk backing a candidate unlikely to finish. I anticipated a California Democrat would step in but was off on the candidate, mistaking Gavin Newsom for Kamala Harris. However, the trend aligned with my forecast.

2. Trump Re-Elected: I consistently communicated that Trump would win the election, providing insights on how to prepare for his second term. Post-election, I outlined three key goals: ending the “manufacturing recession,” increasing fossil fuel production, and pushing AI advancements. Observations indicate these plans are unfolding.

3. Trade Policies and Market Response: When tariffs were imposed in April 2025, I warned of potential market volatility. However, I maintained that this was part of a strategy to reshape global trade, bringing key industries back to the U.S. I predicted that as negotiation efforts progressed, many tariffs would dissipate, allowing for market recovery. The expected trade agreements have started to come through, resulting in a market upturn.

This current rally is not the concluding chapter; it marks a pivotal moment in broader economic strategies.

Upcoming Developments in Trump’s Agenda

What we are witnessing today is only the beginning as the broader implications and policies of the Trump administration unfold.

# Major Economic Shifts Under Trump’s Liberation Day 2.0 Plan

## Overview of the Liberation Day 2.0 Framework

Economic changes are on the horizon with President Trump’s “Liberation Day 2.0” initiative focusing on tax, technology, and energy.

### Tax Liberation

Trump’s proposal aims to use tariff revenue to reduce income taxes for Americans earning under $150,000. This could drive consumer spending, increase wages, enhance business investment, and add trillions to GDP over the next decade.

### Tech Liberation

The U.S. and global governments are investing over $2 trillion in AI, crypto, and cloud infrastructure following the election. With the White House easing regulations, innovation will likely accelerate in these sectors.

### Energy Liberation

The U.S. holds more than $100 trillion in untapped energy and mineral resources. New executive orders are streamlining mining and drilling projects, potentially leading to a significant boom in strategic materials and domestic energy.

## Investment Opportunities in Liberation Day 2.0

Investors should consider positioning their portfolios to capitalize on these emerging opportunities.

### Recommended Stock: Powell Industries Inc. (POWL)

I recommended **Powell Industries Inc. (POWL)** to premium members in December 2023, citing its history of substantial earnings surprises. In the past five quarters, Powell posted earnings surprises of 305.6%, 400%, 233.3%, 130.3%, and 62.5%. The stock has since gained 300%.

Although earnings surprises don’t always yield high profits, Powell’s integration into the AI sector positions it favorably. As AI demand rises, the need for reliable data centers grows. Powell’s products are vital for these data centers.

Other major clients include petrochemical plants and utilities, giving Powell a robust footing to benefit from Tax, Tech, and Energy Liberation.

In Q2 FY2025, Powell secured new orders of $249 million, maintaining a backlog of $1.3 billion. Revenue increased 9% year-over-year to $279 million, with earnings up 38% to $46 million, or $3.81 per share.

### Future Projections

For 2025, analysts anticipate Powell will report $1.12 billion in revenue and earnings of $14.17 per share. The stock currently holds a “B” rating in my Stock Grader system and is recommended as a buy under $227.

## Upcoming Broadcast: Liberation Day 2.0 Blueprint

Investors interested in these trends are encouraged to join a free broadcast on **Wednesday, May 28, at 1 p.m. Eastern**. I will discuss the full Liberation Day 2.0 blueprint and share details on three stocks flagged with higher buy ratings than Powell.

This quantitative system has a strong track record, helping identify significant winners in the market.

## Conclusion

As the economic landscape shifts, Powell Industries and similar companies are set to capitalize on the Liberation Day 2.0 initiative. To learn more, register for the upcoming broadcast.

Sincerely,

**Louis Navellier**

Senior Analyst, **InvestorPlace**

**Disclosure:** Louis currently holds securities in **Powell Industries Inc. (POWL)**.