Costco and AutoZone Kick Off Earnings Season with Strong Results

Costco (COST) and AutoZone (AZO) reported their fiscal quarters ending in May, marking the start of the June-quarter earnings season. Their results pave the way for similar reports from over two dozen S&P 500 companies ahead of the major banks’ results on July 14th.

Costco Beats Expectations Across the Board

Costco exceeded analysts’ estimates for earnings, revenue, and same-store sales, which rose +8% excluding gasoline and foreign exchange impacts. This follows a +9.1% increase in the previous quarter, outperforming estimates of +6.3%.

Notable is the high single-digit growth in Costco’s non-food merchandise. This performance is likely supported by its high-income customer base and growing market share, particularly compared to competitors like Walmart and Target.

Despite tariffs, Costco continues to perform well. Management confirmed that most merchandise for the domestic market is sourced within the U.S., limiting dependency on imports to about 25% of U.S. sales.

Q2 Earnings Expectations and Sector Trends

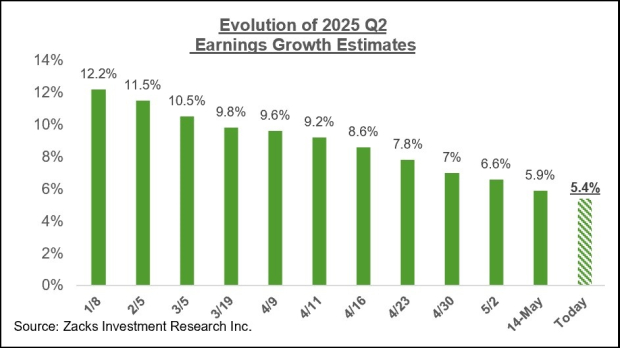

Looking beyond Costco and AutoZone, S&P 500 Q2 earnings are expected to grow by +5.4% year-over-year, with revenues increasing by +3.7%. This marks a slowdown compared to Q1, which saw +12% earnings growth on +4.7% revenue growth.

From April to now, Q2 earnings estimates for 15 of 16 Zacks sectors have declined, with Transportation, Autos, Energy, Basic Materials, and Construction experiencing the most significant cuts. Only the Aerospace sector saw an increase in estimates.

Estimates for the Tech and Finance sectors, which contribute over 50% of S&P 500 earnings, have also been revised down. However, the trend for the Tech sector appears to be stabilizing, as indicated in recent analyses.

Annual Earnings Projections and Market Dynamics

Similar trends are evident in annual earnings estimates. Analysts suggest that easing tariff uncertainties may have contributed to this stabilization. Initial revisions followed early April tariff announcements, but concerns about punitive tariffs lessened, aiding steady revisions.

The upcoming Q2 earnings and revenue growth expectations continue to be evaluated against historical performance over the last five quarters.

Current Q1 Earnings Status

As of May 30th, Q1 earnings season is nearly completed, with 490 S&P 500 members (98% of the index) reporting results. Earnings are up +11.9% year-over-year on +4.8% revenue growth, with 74.1% of companies surpassing EPS estimates and 63.3% exceeding revenue estimates.

Historical context shows that the EPS beats percentage of 74.1% is below the 20-quarter average of 78.4%. Similarly, the revenue beats percentage of 63.3% lags behind the 5-year average of 71.2%.

For more insights into the earnings landscape, check our weekly Earnings Trends report.

Conclusion

The performance of Costco and AutoZone sets a strong tone for the upcoming earnings season, amid broader trends showing both growth and caution across various sectors. Stakeholders should prepare for ongoing earnings updates as the season unfolds.

The views and opinions expressed herein do not necessarily reflect those of Nasdaq, Inc.