Microsoft’s Strong Earnings Face AI Capacity Constraints Ahead

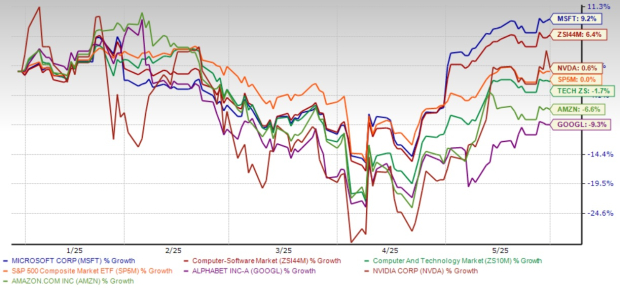

Microsoft (MSFT) has posted a 9.2% year-to-date return, raising questions among investors about its valuation. The company reported record quarterly results, but concerns about valuation are present as it accelerates its artificial intelligence (AI) initiatives.

Strong Financial Foundation Supports Current Valuation

In its fiscal third quarter of 2025, Microsoft generated $70.1 billion in revenue, representing a 13% increase. Cloud revenues reached $42.4 billion, marking a 22% growth in constant currency despite economic challenges.

The Intelligent Cloud segment, which includes Azure, saw revenues of $26.8 billion with a 21% growth rate. Azure grew by 33%, driven partly by a 16-percentage-point boost from AI services. Strong commercial bookings showed an 18% growth rate and the company recorded $315 billion in remaining performance obligations, indicating healthy future revenue streams.

Microsoft also reported free cash flow of $20.3 billion for the quarter, highlighting its capability to create shareholder value. The company’s diversified revenue streams across various segments provide defensive qualities amid economic uncertainty.

The Zacks Consensus Estimate projects Microsoft’s fiscal 2025 revenues to reach $278.8 billion, indicating a year-over-year growth of 13.47%. The consensus estimate for earnings stands at $13.33 per share, representing a 12.97% increase year-over-year.

Image Source: Zacks Investment Research

AI Innovation Driving Long-Term Growth Prospects

Recent product launches highlight Microsoft’s commitment to AI. The introduction of the Agent Store in May 2025 creates a new marketplace for AI-powered assistants, potentially providing new revenue avenues beyond software licensing. This platform currently hosts over 70 agents, offering developers monetization through Microsoft 365 Copilot integration.

Microsoft’s gaming initiatives, including the global rollout of Edge Game Assist, show its capability to utilize AI across various user experiences. This in-game browser aims to enhance user engagement and data collection, which may support future advertising revenue growth.

The NLWeb project aims to convert websites into AI-powered applications, positioning Microsoft as a key player in the broader AI ecosystem. This open-source strategy could drive increased adoption of Microsoft’s AI infrastructure and benefit the Azure platform.

Additionally, Microsoft will invest $400 million in Switzerland to develop its cloud computing and AI infrastructure.

Capacity Constraints Present Near-Term Headwinds

Despite solid demand, Microsoft faces AI capacity constraints which may hinder short-term growth. Management has indicated that some AI capacity limitations could persist beyond June 2025, suggesting revenue growth may be limited by supply rather than demand.

Ongoing capital expenditure requirements, including the recent $400 million investment in Switzerland, signal significant infrastructure spending needs. While these investments bolster long-term competitiveness, they also pressure near-term margins and cash flow conversion rates.

Valuation Considerations for Entry in the Second Half of 2025

Microsoft’s current valuation assumes optimistic expectations for AI monetization and cloud market share. The 9.2% year-to-date appreciation has coincided with overall tech sector strength, which may limit new investors’ margin of safety.

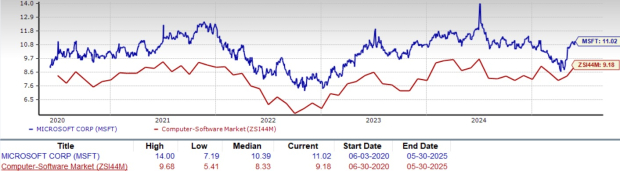

Forward price-to-earnings ratios remain higher than historical averages, justified by the company’s market position and growth prospects. Microsoft’s current valuation of 11.2 times forward sales exceeds the Zacks Computer – Software industry average of 9.8 times.

MSFT’s P/S F12M Ratio Depicts Stretched Valuation

Image Source: Zacks Investment Research

Sensitivity to interest rates and tech sector sentiment could provide better entry points later in 2025. Earnings surprises, changing AI spending trends among enterprise customers, or shifts in competitive dynamics may further influence volatility.

Microsoft faces competitive pressures in the AI sector from tech giants like Alphabet (GOOGL), Nvidia (NVDA), and Amazon (AMZN). Year-to-date, Microsoft has outperformed its peers, while shares of Google and Amazon have declined by 9.3% and 6.6%, respectively, with Nvidia slightly up by 0.6%.

Year-to-Date Performance

Image Source: Zacks Investment Research

Investment Recommendation: Hold With Tactical Patience

Investors should hold their positions in Microsoft due to its strong competitive advantages and diversified revenue streams. The company’s robust free cash flow generation supports long-term wealth creation.

However, new investors may find it prudent to adopt a patient approach, awaiting more favorable market conditions.

# Anticipated Market Pullbacks May Create Better Entry Points

Investors are advised to wait for potential pullbacks in the second half of 2025 before establishing new positions. Elevated valuations, capacity constraints, and overall market volatility indicate that more favorable entry opportunities could arise during earnings-driven corrections or periods of macroeconomic uncertainty.

Microsoft’s outlook remains strong. However, timing could greatly affect investment returns for those not currently invested in the stock. Presently, Microsoft holds a Zacks Rank #3 (Hold).

## Zacks Identifies Leading Semiconductor Stock

Zacks mentions a top semiconductor stock, which is significantly smaller than NVIDIA, which has surged over 800% since its recommendation. While NVIDIA maintains strength, this new chip stock shows potential for considerable growth.

The company reports strong earnings growth and an expanding customer base, making it well-positioned to meet the rapidly increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to grow from $452 billion in 2021 to $803 billion by 2028.

This article originally appeared on Zacks Investment Research.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.