Credo Technology Prepares for Earnings Report on June 2, 2025

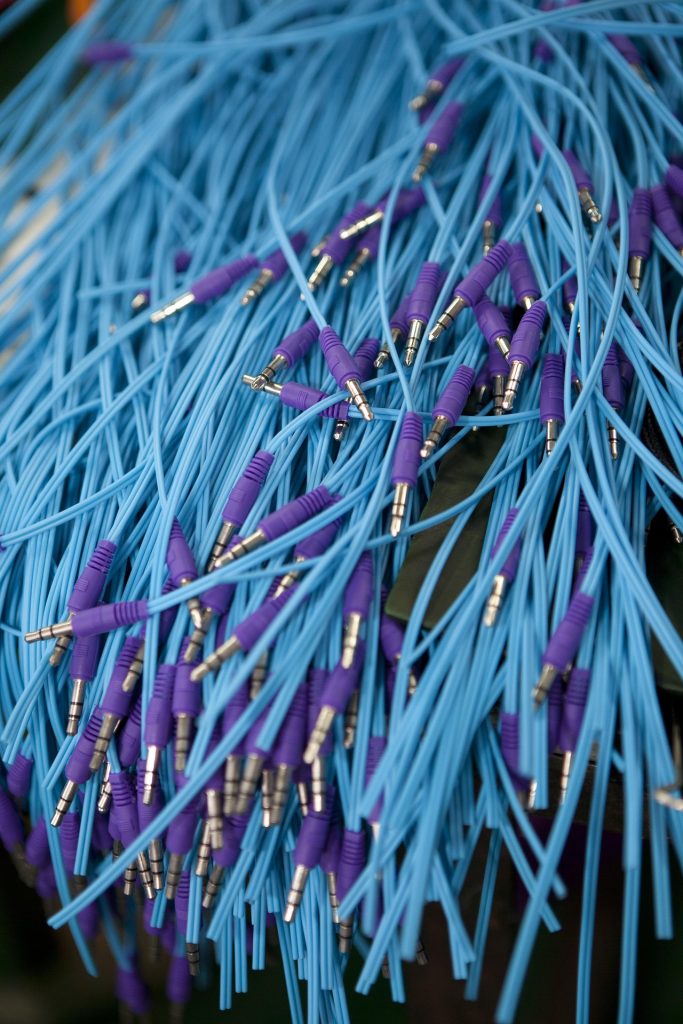

Credo Technology (NASDAQ:CRDO), a company specializing in electrical cables and interconnect products, will report its earnings on June 2, 2025. Historical data since 2022 indicates an equal chance of the stock’s price rising or falling post-announcement. The company has achieved a positive one-day return in 54% of its earnings releases over the last three years. During these positive instances, the median one-day return was 23.2%, while the maximum return reached 47.9%, indicating notable volatility surrounding earnings events.

Both actual results and analyst expectations will be critical for investors. Traders may consider two strategies:

- Pre-earnings Positioning: Assess historical trends and take positions prior to the earnings report.

- Post-earnings Positioning: Analyze immediate and medium-term returns after the earnings release and adjust positions as needed.

Analysts predict Credo Technology will report earnings of $0.27 per share and sales of $159.59 million, a significant increase from $0.07 per share and $60.78 million in the same quarter last year. Currently, Credo Technology has a market capitalization of $10 billion, with $328 million in revenue over the past twelve months, alongside an operating loss of $3.8 million and a net income of $5.1 million.

Historical Probability of Positive Post-earnings Returns

Analysis of one-day post-earnings returns reveals:

- In the last five years, the company recorded 13 earnings data points with 7 positive and 6 negative one-day returns, resulting in 54% positive outcomes.

- This percentage increases to 58% when considering the last three years.

- The median return for positive instances is 23%, while the median return for negatives is -6.4%.

Additional data on 5-day and 21-day post-earnings returns is summarized in the accompanying table.

Correlation of Short-term and Medium-term Returns

Understanding the correlation between short-term (1D) and medium-term (5D) returns can inform trading strategies. If a strong correlation exists, a trader may choose to go long for the following 5 days after a positive 1D return. Correlation data is provided for both 5-year and 3-year periods.

Impact of Peers’ Earnings on Stock Reaction

Peer performance often influences post-earnings stock reactions, sometimes leading to price adjustments before the earnings announcement. Historical data comparing Credo Technology’s performance to that of peers reporting earnings around the same time is available.

Investors interested in a less volatile option may consider Trefis’s High Quality portfolio, which has outperformed the S&P 500 and achieved returns exceeding 91% since inception.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.