“`html

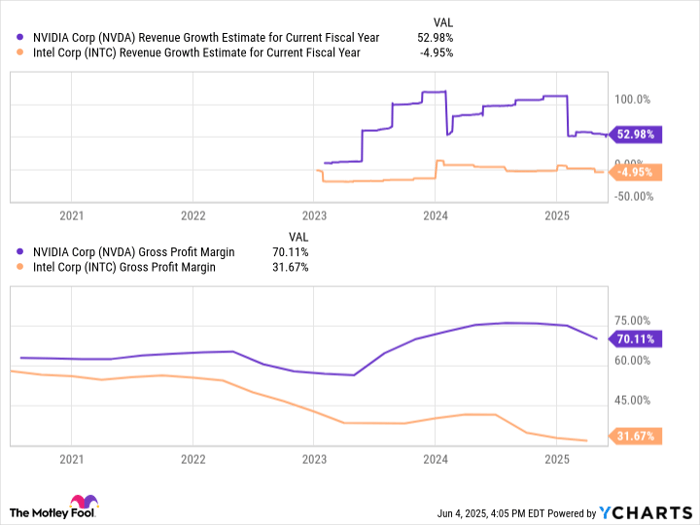

Intel (NASDAQ: INTC) has faced declining market share and missed opportunities in the AI sector, leading to a 70% drop in stock price since April 2021, despite a significant investment of over $50 billion in new chip-making facilities over the past two years. The company’s primary focus has shifted to its foundry business, which currently lacks profitability and faces fierce competition from Taiwan Semiconductor and Samsung.

As of June 2025, Intel’s market capitalization stands at $88.3 billion, with a price-to-sales ratio of 1.7 and a price-to-book ratio of 0.9, indicating the stock is undervalued compared to competitors like AMD (P/S 6.9) and Nvidia (P/S 23.3). This shift in strategy aims to capitalize on the potential domestic demand for chips, countering trade tensions and supply chain risks associated with overseas manufacturing.

While the long-term success of Intel’s foundry initiative remains uncertain, some analysts consider its current stock prices an attractive opportunity for investment, suggesting potential growth in the coming years.

“`