“`html

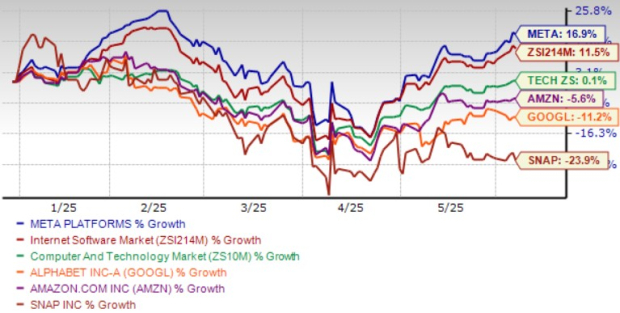

Meta Platforms (META) has seen a stock appreciation of 16.9% year-to-date (YTD), outperforming competitors like Alphabet (GOOGL), Amazon (AMZN), and Snap (SNAP), whose shares dropped 11.1%, 5.6%, and 23.9% respectively over the same period. By 2028, Meta, Alphabet, and Amazon are projected to account for around 50% of global ad spending.

Meta’s focus on integrating artificial intelligence across its platforms, which have over 3.43 billion daily users, has led to a 7% increase in time spent on Facebook and significant improvements in ad performance. Capital expenditures for 2025 are expected to be between $64 billion and $72 billion, bolstered by AI initiatives aimed at enhancing user engagement and advertising revenues.

Despite these advancements, Meta’s shares are considered overvalued with a forward Price/Sales (P/S) ratio of 8.79X, compared to the industry average of 5.61X. The Zacks Consensus Estimate for Q2 2025 earnings stands at $5.83 per share, reflecting a year-over-year increase of 12.98%.

“`