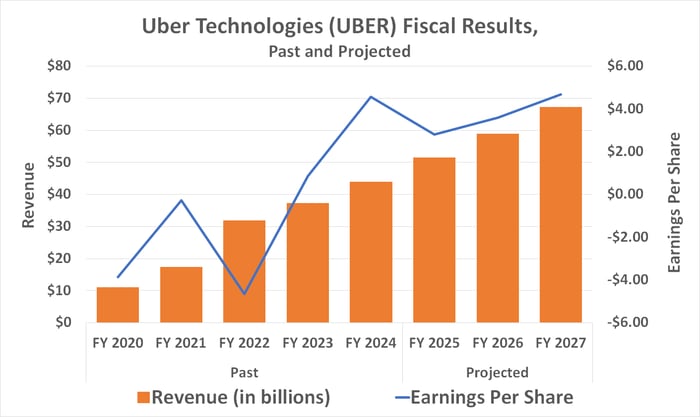

Uber Technologies (NYSE: UBER) controls approximately 75% of the U.S. ride-hailing market, providing over 11 billion rides in 2022 and generating nearly $44 billion in revenue. Carvana (NYSE: CVNA), a used car dealer, reported $13.7 billion in revenue for 2024, marking a 27% increase year-over-year, and achieved a record net income of $404 million. Uber’s growth is largely attributed to a shift in consumer attitudes toward vehicle ownership, with 44% of people under 35 considering not owning a car, while Carvana’s growth is driven by the increased demand for affordable used vehicles, especially as new car prices soar to an average of $48,699.

Carvana’s shares have surged over 200% in the past year, whereas Uber shares have remained relatively stagnant. Despite Carvana’s recent performance, analysts rate Uber as a stronger investment opportunity, with its stock trading 16% below the target price of $97.39 compared to Carvana’s stock trading 14% above consensus estimates.

Despite both companies’ recent success, Uber is better positioned for sustained growth due to broader market trends favoring ride-hailing services over personal vehicle ownership, while Carvana may face challenges from inventory shortages in the used car sector.