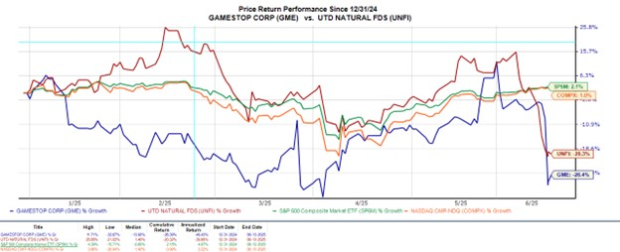

GameStop (GME) and United Natural Foods (UNFI) reported quarterly earnings exceeding expectations on Tuesday; however, their stock prices plunged over 20% and 15%, respectively, since the announcements. GameStop’s stock fell following the announcement of a $1.75 billion convertible note offering, raising concerns about share dilution, while United Natural Foods was affected by worries from a cyberattack disrupting operations.

GameStop’s Q1 earnings of $0.17 per share surpassed expectations of $0.07, marking a significant improvement from an adjusted loss of -$0.12 per share in the previous year. Meanwhile, United Natural Foods reported a Q3 EPS of $0.44, outperforming estimates of $0.24 by 83% and increasing from $0.10 in the prior year’s quarter. GameStop’s annual earnings projections for FY26 are now forecasted to rise 127% to $0.75 per share, while United Natural Foods is projected to achieve an EPS of $0.80 for the current year.

Both companies hold a Zacks Rank of #3 (Hold), indicating that while recent operational performance shows promise, investors should closely monitor EPS revisions as they navigate current stock prices relative to the S&P 500’s forward earnings multiple of 23.3X.