“`html

In 2025, the stock market has seen erratic fluctuations, prompting investors to remain vigilant for potential buying opportunities during dips. Analysts emphasize that preparing in advance can help eliminate emotional decision-making when investing.

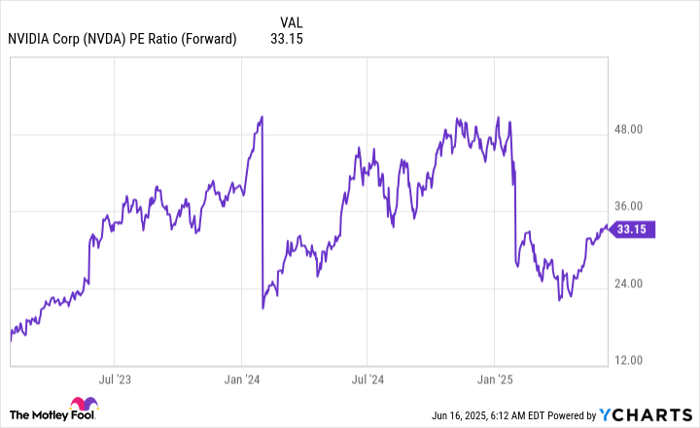

Key companies to watch include Nvidia and Amazon. Nvidia (NASDAQ: NVDA) holds a staggering 90% market share in the GPU sector, primarily driven by increasing demand for AI computing, suggesting ongoing long-term growth potential as AI deployment expands. In its current valuation, Nvidia’s stock trades at 33 times forward earnings.

Meanwhile, Amazon (NASDAQ: AMZN) derives a significant portion of its profits from Amazon Web Services (AWS), which accounted for 63% of its total operating profits in Q1 2025, despite comprising only 19% of revenue. As a leading cloud computing provider, AWS will likely benefit from the ongoing shift to cloud technologies, maintaining a high-profit margin in the face of tariff challenges affecting its e-commerce segment. Amazon’s stock is currently valued at 34 times forward earnings.

“`