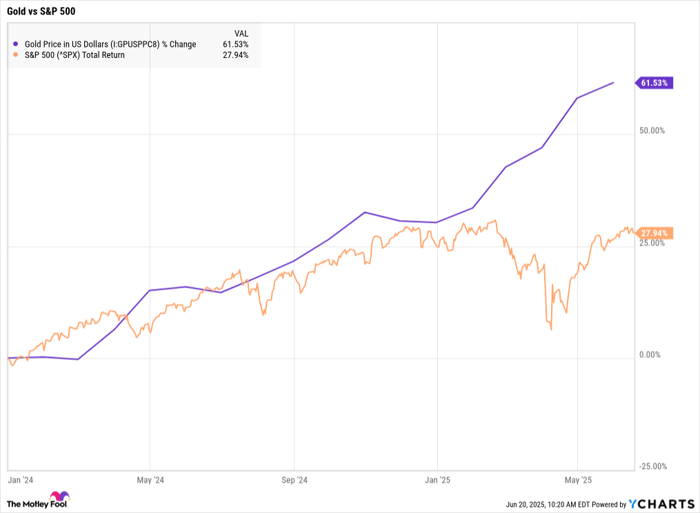

The price of gold has risen approximately 60% in the last 18 months, outpacing both stocks and bonds, as investors seek safer assets amid global uncertainties. J.P. Morgan analysts project that gold could reach $4,250 per ounce by the end of 2026, an increase of another 25% from current levels.

In contrast, Warren Buffett and his colleague Charlie Munger advise against investing in gold, citing better alternatives such as real estate and index funds. Buffett highlighted that productive assets, like farmland, can provide income and growth over time, emphasizing that while gold maintains its value, it lacks utility beyond being a non-productive asset.

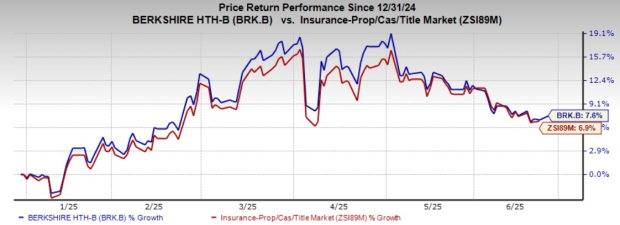

Historically, since Buffett took over Berkshire Hathaway in 1965, gold’s value has increased nearly 100-fold, while Berkshire’s value skyrocketed by approximately 58,664-fold, reinforcing the preference for investments that generate returns.