Unisys Corporation (UIS) announced early success with its Device Subscription Service (DSS) in the first quarter of fiscal 2025, which has contributed to new contract wins. DSS combines device procurement, deployment, refresh cycles, and support services, and is expected to increase demand as clients shift towards AI integration and Windows 11 upgrades.

Management anticipates a significant ramp-up in PC refresh activity, which could lead to a boost in field services, logistics, and device management. As DSS gains traction, Unisys is effectively leveraging this as a platform for cross-selling additional services, enhancing client retention. The backlog in the Digital Workplace Solutions segment is growing at a double-digit rate year-over-year, positioning Unisys for potential sequential growth in the latter half of 2025.

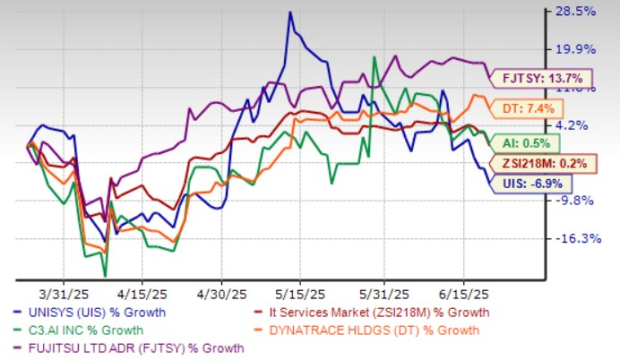

Despite a 6.9% decline in share price over the past three months, Unisys is currently trading at a forward price-to-sales ratio of 0.15X compared to the industry average of 18.47X. The Zacks Consensus Estimate for Unisys’ 2025 earnings per share has risen significantly from 25 cents to 58 cents, indicating strong analyst confidence.