“`html

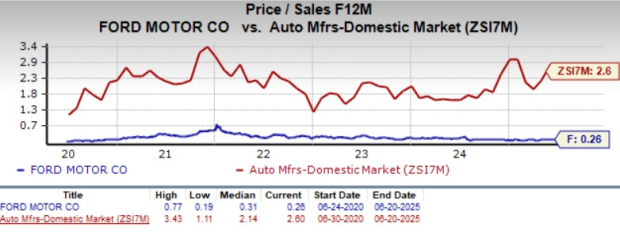

Ford’s stock (F) is currently trading at a forward 12-month price-to-sales (P/S) ratio of 0.26, below both industry averages and its own 5-year average. For comparison, General Motors (GM) has a P/S of 0.27, while Tesla (TSLA) is significantly higher at 9.88. Ford is up approximately 7% year-to-date, contrasting with industry losses exceeding 19%, while GM and Tesla have declined nearly 10% and 20%, respectively.

Ford’s financial position appears strong, ending Q1 2025 with roughly $45 billion in liquidity, including $27 billion in cash. However, it faces challenges in its EV segment, which reported a loss of $5.07 billion in 2024, driven by pricing pressure and increased investment in new-generation EVs. Furthermore, Ford anticipates a significant negative impact of around $1.5 billion from shifting tariffs on its adjusted EBIT in 2025.

Sales and earnings estimates for 2025 show a year-over-year decline of 7% and 40%, respectively, prompting questions about Ford’s near-term outlook. Despite its favorable valuation metrics, investors are advised to adopt a wait-and-see approach while observing the company’s performance in the coming quarters.

“`