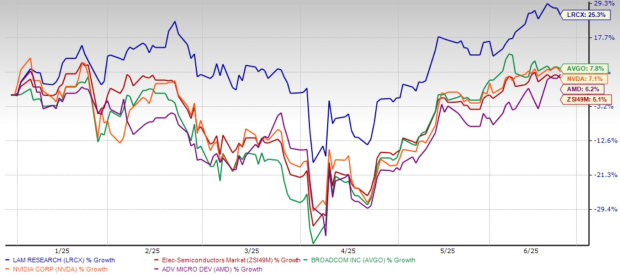

Lam Research Corporation (LRCX) has seen a significant year-to-date stock price increase of 25.3%, outperforming the Zacks Electronics – Semiconductors industry, which recorded a mere 5.1% increase during the same period. In comparison, key semiconductor peers like Broadcom Inc. (AVGO), NVIDIA Corporation (NVDA), and Advanced Micro Devices, Inc. (AMD) have only risen 7.8%, 7.1%, and 6.2%, respectively.

In the third quarter of fiscal 2025, Lam Research reported revenues of $4.72 billion, marking a 24.5% year-over-year increase. The firm’s non-GAAP EPS rose 33.5% due to robust demand from memory and logic customers. The company anticipates shipping over $1 billion worth of products for next-generation chip nodes in 2024, with expectations to triple that figure in 2025.

P/E multiples indicate that LRCX trades at a forward price-to-earnings (P/E) multiple of 22.7X, which is lower than the industry average of 30.91X and below competitors like AMD, NVIDIA, and Broadcom, indicating a reasonable valuation after its recent rally.