Coinbase Global (NASDAQ:COIN) saw its stock surge by 16% on Wednesday and reports an overall increase of nearly 20% over the past week, following the Senate’s passage of a stablecoin regulation bill. This legislation aims to provide a framework for regulating digital tokens pegged to the U.S. dollar, requiring full reserve backing, monthly audits, and anti-money laundering compliance.

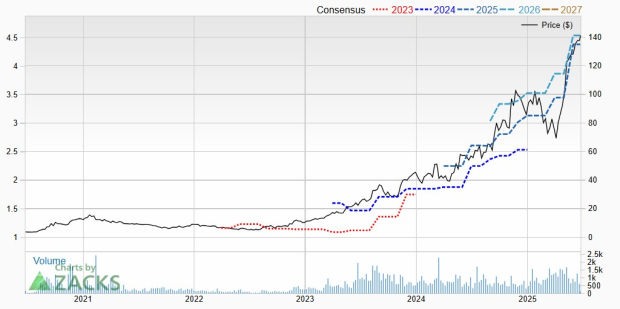

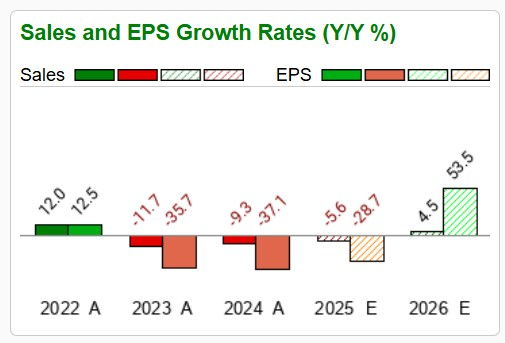

Coinbase, which benefits as stablecoins are its second-largest revenue source, recently launched Coinbase Payments, allowing online merchants to accept USDC. Key metrics reveal Coinbase’s price-to-sales (P/S) ratio is 9.5 compared to 3.1 for the S&P 500, while its revenues grew 75.2% from $4.0 billion to $7.0 billion over the last 12 months.

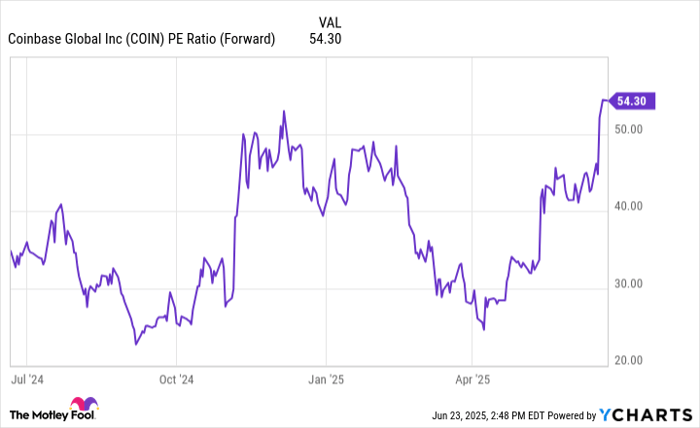

While Coinbase showcases strong revenue growth, with a net income margin of 21.1%, the company’s valuation remains high and volatile. As of the latest quarter, it holds $4.3 billion in debt against a $75 billion market capitalization, indicating a debt-to-equity ratio of 6.5%. Coinbase’s stock is considered an attractive yet risky buy due to its strong growth and profitability juxtaposed with high valuation and market volatility.