“`html

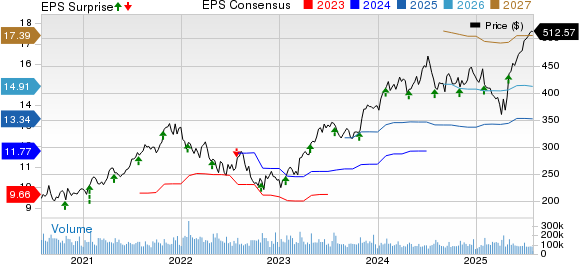

Warren Buffett has invested over $77.8 billion in buybacks for Berkshire Hathaway (NYSE: BRK.A, NYSE: BRK.B) since 2018, emphasizing his preference for his own company over other significant investments like Apple. Berkshire operates a $283 billion portfolio and reported a compound annual return of 19.9% since Buffett took over in 1965, substantially outperforming the S&P 500’s 10.4% during the same period.

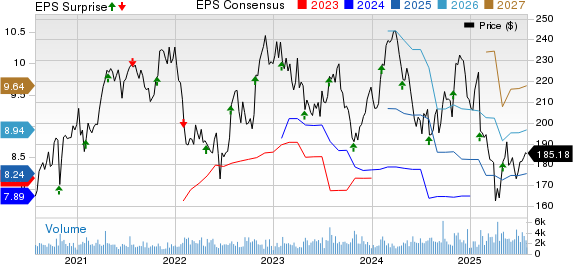

An investment of $1,000 in Berkshire in 1965 would be valued at approximately $44.7 million by the end of 2024, while the same investment in the S&P 500 would only be about $342,906. Berkshire held a stake in Apple worth over $170 billion at the start of 2024, which is half of its total portfolio value, illustrating Buffett’s significant investment strategy.

“`