Energy Transfer LP announced a capital expenditure investment of $955 million in Q1 2025, with plans to allocate a total of $5 billion for expanding its midstream infrastructure throughout the year. These investments focus on key projects such as the Gulf Run Pipeline and new fractionation plants in Mont Belvieu, enhancing the company’s capacity in natural gas, NGLs, and crude oil segments amidst increasing U.S. energy production and export demand.

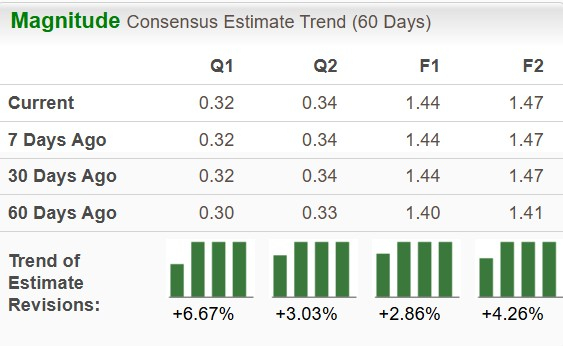

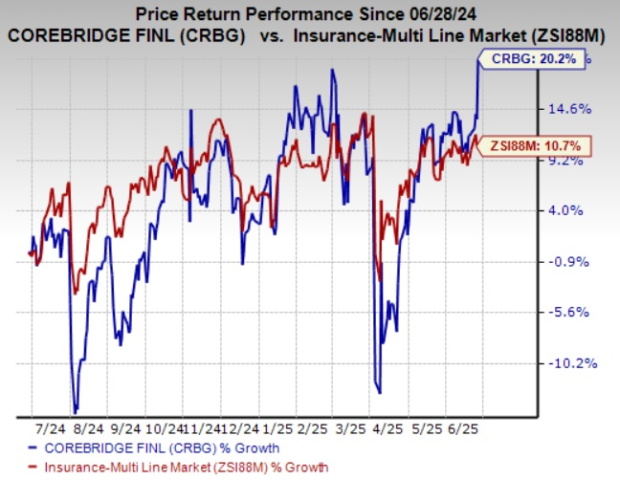

Energy Transfer’s disciplined capital strategy is aimed at improving operational efficiency and asset integration, contributing to long-term cash flow stability and unit-holder distributions. Notably, the Zacks Consensus Estimate for the company’s earnings per unit has increased by 2.86% for 2025 and 4.26% for 2026 over the last 60 days. Despite a trailing return on equity of 11.47%, below the industry average of 13.95%, ET units have increased by 2.3% over the past month, contrasting with a 0.5% decline in the broader pipeline industry.