“`html

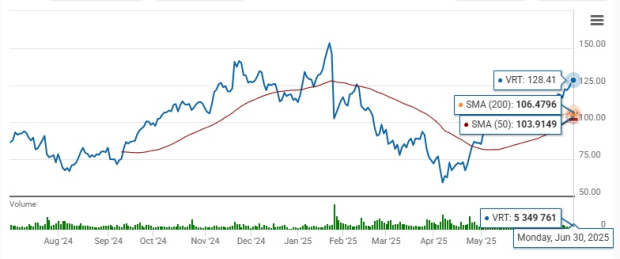

Vertiv (VRT) is currently trading at $128.41, significantly above both its 200-day simple moving average (SMA) of $106.47 and 50-day SMA of $103.91, indicating a strong upward trend. The stock has gained 13% year-to-date, outperforming the broader Zacks Computer and Technology sector, which increased by 6.1%. In comparison, the Zacks Computers – IT Services industry declined by 7.3% during the same period. Vertiv’s backlog has reached $7.9 billion, up 10% sequentially and 25% year-over-year, driven by a 20% growth in organic orders.

For the fiscal year 2025, Vertiv raised its revenue guidance to between $9.325 billion and $9.575 billion, along with expectations for organic net sales growth of 16.5% to 19.5%. Non-GAAP earnings are projected between $3.45 and $3.65 per share. Additionally, the consensus estimate for second-quarter 2025 revenue stands at $2.27 billion, reflecting a year-over-year increase of 16.48%.

The company’s strong performance is attributed to partnerships with companies like NVIDIA and Tecogen, enhancing its cooling and energy solutions. Vertiv has a Zacks Rank of #2 (Buy) with a Growth Score of A, highlighting its positive market sentiment and potential for further growth.

“`