“`html

Tesla (TSLA) shares fell over 5% recently, affected by ongoing political tensions between CEO Elon Musk and former President Donald Trump. This decline comes just before Tesla’s Q2 delivery report, which is expected to show disappointing numbers.

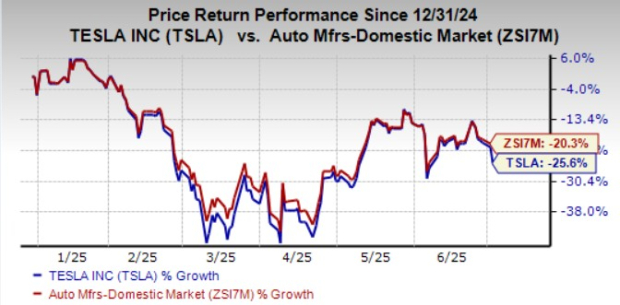

The conflict began in early June when Musk criticized Trump’s tax bill, leading to Trump’s harsh rebuttal questioning Musk’s reliance on government subsidies. Following this exchange, on June 5, Tesla lost over $150 billion in market value—its largest single-day drop. Additionally, Trump’s proposed tax bill threatens to eliminate the $7,500 federal EV credit and other incentives that benefit Tesla’s solar and battery divisions, which could impede future growth amid increasing competitive pressures. Tesla’s stock has dropped about 25% year-to-date, compared to a 20% decline in the broader industry.

If Trump’s bill passes, it may disproportionately harm Tesla by excluding established manufacturers from certain tax credits while favoring newer companies like Rivian and Lucid, further complicating Tesla’s pricing strategy and market traction.

“`