Applied Materials (NASDAQ:AMAT) is projected to potentially reach stock prices of up to $380 in the coming years, driven by increased capital expenditures from the generative artificial intelligence boom. A report by SEMI forecasts that global capital expenditures for advanced chip-making equipment will nearly double from 2023 to 2028, with expectations to exceed $100 billion in 2025. Applied materials specializes in equipment for semiconductor manufacturing, serving clients like TSMC, Samsung, and Intel.

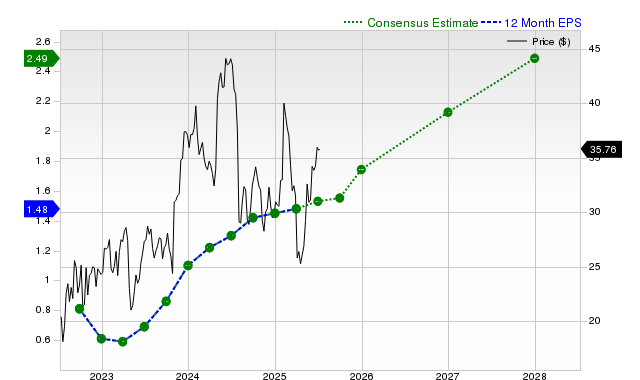

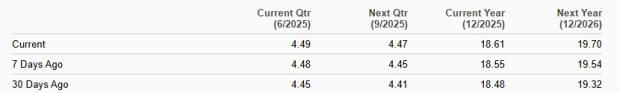

The company has seen a 13% annual revenue growth over the past five years, with projected sales of $29 billion for FY’25. If sales grow at an estimated 22% annually, revenues could reach around $53 billion by FY’28—an 81% increase. Adjusted net margins have improved from 19.6% in FY’19 to 26.5% in FY’24, with expectations to reach 31% by FY’28.

China accounted for over a third of Applied’s revenue in FY’24, but easing U.S.-China trade tensions may allow greater market access. The combination of significant revenue growth and increasing margins could lead to a potential doubling of AMAT’s stock price from about $190, solidifying its positioning in the semiconductor sector.